|

A Progressive Foundation for America's Economic Future

By

- September 28, 2010 - September 28, 2010

I believe that the United States is at a critical turning point in

history, and specifically that the American economy has reached a point of

development where significant and fundamental changes are needed to the

foundational structure of the American economy in order to ensure continued

growth and prosperity. I believe that without major changes to the core

structure of the American economy, the American economy is destined to enter

a period of prolonged stagnation and decline.

Both the American economy and the world economy have changed dramatically

over the past sixty years. The policies, structures, and institutions that

were successful in promoting economic growth and providing economic security

in the past will not be sufficient to do the same going forward. What we

have to recognize today is that we are at a point where the past is not

longer a model for the future. This has been the key failure of leading

economists, investors, and business leaders over the past decade. Time and

time again economists and pundits have continued to use the past 60 years of

economic patterns as a predictor of future economic trends, but the problem

is that the future now looks fundamentally nothing like the past.

In the run up to the housing market crash, we heard economists and

pundits repeatedly claim that "history shows that housing prices never drop

significantly at a national level", and yet they did. Why? Because the

conditions of the housing market in 2002-2007 were significantly different

than they were at any time from the end of World War II up to 2000. Today we

still hear economists and pundits claiming that investing in the stock

market is a good idea, because "historically, the market has gone up by 10%

a year". That may well be (it is actually not true), but as the disclaimer given by every investment

institution says "past performance is not a predictor of future results".

Fundamental changes in the American and global economy mean that the past

and present way of doing things are simply not going to work in the future,

at least not very well.

A progressive agenda for transforming the American economy is not only

the right approach from a moral and ethical perspective, but it

is also the most effective way to ensure stable and continued strong

economic growth. The regressive economic agenda of the past thirty years has

led to a dramatic increase in debt and economic disparity in America, which

is exactly what is currently undermining the American economy. Increasing

economic disparity is a road that always eventually leads to a dead-end and

economic stagnation. It is inevitable. There is no economic model in which

there can be both long-term economic growth and increasing economic

disparity, because broad based consumption is always the engine of economic

growth. If the majority of people are unable to afford to either purchase

commodities or to invest in their own new businesses, then the economy has

no basis for growth.

And thus, a progressive agenda that works toward reducing economic

disparity and ensuring economic security is in fact the only way to ensure

long-term economic growth. The reality is that the economic growth of the

past thirty years, the Reagan and post-Reagan era, has been fueled by debt and cost cutting

on long-term investment for short-term gain, with the vast majority of the

economic growth that has taken place being realized by the wealthiest 0.5% of

the nation. This strategy has led us to the dead end that our economy is now

facing today.

And yet, while the need for a strong progressive agenda is great, and

the evidence of failure of the so-called "conservative" economic agenda is

overwhelming, at present in America we face a strongly resurgent

"conservative" movement with no signs of any significant

progressive leadership or policy agenda to deal with the fundamental

problems facing America today, and

so, with that, I would like to outline what I believe are some major steps

that should be taken in order to put the American economy on track for both

long-term economic fairness and growth.

- Replace tariffs with international production standards

- Federal Tax reform

- Eliminate distinctions between types of income

- Overhaul tax brackets, creating brackets for very high

incomes

- Eliminate virtually all tax deductions

- Create new type of corporate entity

- Fix Social Security

- Index future benefit increases on the rate of inflation, not on

average wages

- Remove the cap on the Social Security tax, so that the tax will

apply to all income amounts

- Apply the Social Security tax to all forms of income, not just

payroll income

- Reduce the tax from 12% to 5%-6%

- Implement a National Individual Investment Program

- Real health care reform

- A Single Payer system

- Address the root causes of health problems

- Increased funding for Medicare

- Overhaul employer compensation practices

- Move hidden taxes from employers to employees

- Require reporting of employer financials to employees

- Create a permanent Office of Job Creation

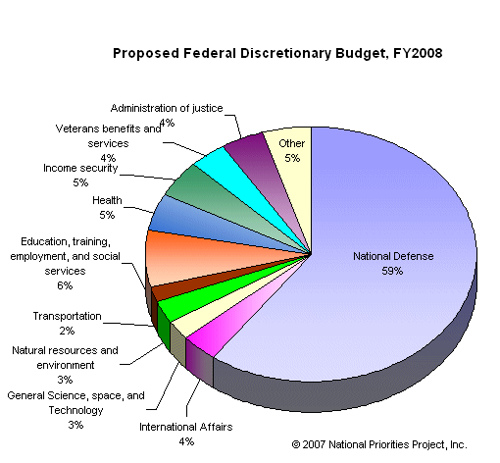

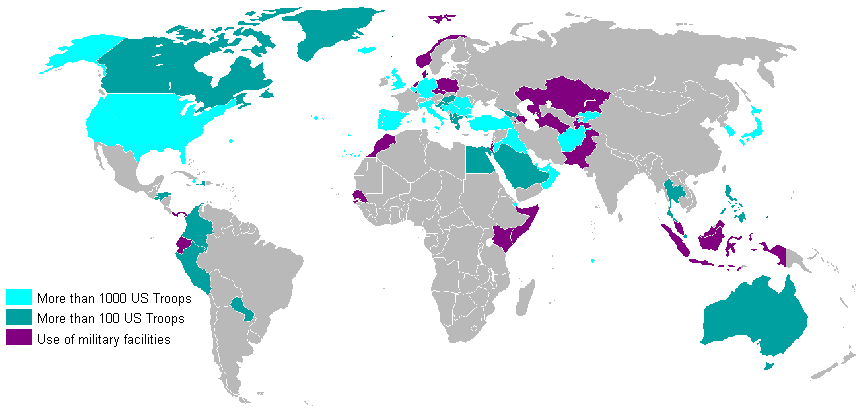

- Dramatically reduce Military spending

- Reduce the global American military footprint

- Eliminate earmarks and virtually all contractors; Create government

entity for production of military hardware

- Reduce the ranks of the enlisted, especially top brass

- Implement a new military funding tax on imported fuels

Replace tariffs with international production standards

When Adam Smith wrote in favor of free trade in the 18th century, he did

so based on a number of assumptions which are no longer true. Adam Smith

believed that producers would never outsource production to foreign

countries under the reasoning that that any decent producer would understand

that the accumulation of capital within their home country benefited the

nation and would thus not export capital to foreign countries. The purpose

of free trade, in Smith's line of thinking, was to allow nations to exchange

goods with other nations that could not be domestically produced, or could

not be domestically produced as well due to lack of expertise or due to lack

of materials. The purpose of free trade was to exchange goods among nations

that other nations lacked. The notion of mass exportation of production to

foreign countries due to dramatically lower labor costs is not present in

Adam Smith's economic writings, because such a condition didn't really exist

during his time.

Today, however, the primary driver behind international trade is not an

exchange of goods that can't be produced domestically, rather the primary

driver is production costs, and all across the developed world capital is

exported to foreign countries where production costs are lower, not

because those countries possess goods or materials or methods that are lacked

domestically, but because they provide laborers who will work for less pay

and governments that don't enforce environmental or safety standards as

protective as those in developed nations.

This current system of international trade is highly inefficient and dominated by

producers' pursuit of the cheapest labor and lowest taxes and regulatory

requirements. The result of this is that material goods are transported all

over the world, thousands of miles, wasting fuel, shipping materials, and

time, just due to discrepancies in production costs. And the discrepancies

in the production costs are not even products of efficiency themselves, in

other words, they are not a product of production in China or other

producing nations being more timely or using fewer resources, the

discrepancies are products of lower compensation in those countries and

lower regulatory requirements, leading to higher overall pollution output

and overall environmental degradation.

Today, for example, timber, cotton and other materials are harvested in the United

States, shipped to China, where they are processed and turned into

furniture, then shipped back to the United States where they are sold and

consumed.

The primary means of regulating international trade today is tariffs,

however tariffs are a fundamentally bad method of controlling international

trade. The way that tariffs basically work is that governments place import

taxes on certain products coming from certain countries. The system is

fraught with problems and abuses, but even more than that, the tariff system

fundamentally undermines the long-term economic goals of the both the nation

issuing them and the nation subject to them.

The tariff system works through treaties and trade agreements

whereby certain duties are placed on items from individual countries, and based on

agreements some countries or products may be exempt from such tariffs, etc.

This greatly politicizes international trade on the one hand, and it also

lumps all businesses together by country on the other hand.

But worse than this is the fact that, from a cost competition point of

view, tariffs drive behavior in the opposite direction of the desired

outcome. There are multiple reasons for employing the use of tariffs, but

one of the major reasons is simply to protect domestic producers from foreign

competition by placing an import duty on items from foreign countries where

production costs are lower so as to increase the cost of bringing the

foreign goods to market in the domestic market in order to make the cost of

bringing them to market comparable with the cost of bringing domestic goods

to market.

The problem with this is that the reason that it's cheaper to brining

foreign goods to market in the first place is typically that the

wages paid to the foreign workers are significantly less, the regulatory

standards are lower, and in some cases the taxes at the point of production

are lower, and by placing an additional fee on top of the production cost of

the items in order to import them, all it does is actually provide an

incentive to keep the wages low, and for the country of origin to resist

increases in regulatory standards and taxes.

Ultimately, however, what is in both the best interest of both the

importing and the exporting country is that wages go up, regulatory

standards increase, and potentially that taxes increase. The natural

tendency in a true "free market" is price stabilization, but what tariffs

do is they actually interfere in a way to impede that natural

tendency toward stabilization. In some cases agreements are made such that

tariffs are tied to conditions, such as saying that the tariff will be

reduced, eliminated, or re-evaluated if certain environmental standards or

wage standards are met, etc., but even in these cases, the exporting nation

has to work against the natural pressure of the tariff to make changes and

it just makes making those changes more difficult than it should naturally

be.

So what is the solution here? What we want is for wages, environmental

standards and safety standards to go up in developing countries so that the

populations in those countries can become potential consumers of American

goods and services, and so that the cost/benefit of producing goods in those

countries instead of America is reduced or eliminated, all while

facilitating raising living standards of people in developing countries.

The way to do this is to eliminate tariffs, and instead implement

production standards that are enforced on a per-producer basis instead of a

per-nation basis. There are certainly complications to this, and it wouldn't

be entirely easy and it wouldn't be without its own potential for problems

and abuse, but I believe that the costs would be worth the benefits.

Here is how it could work.

Anyone importing over $X amount of goods would have to provide a

statement of wages from the producer of the goods, for each producer

involved in the production of the goods, i.e. if the good had parts

manufactured by one producer and it was assembled by another, etc., you need

a statement of wages from each. Foreign producers would also be able

register with a department in the US so that their information would simply

be on file, and thus the practical reality is that for most of the goods

that are imported all of this information would be on file. Certain

countries could be classified as exempt, and thus have full free trade, if

it is deemed that their overall production standards meet or exceed certain

guidelines. For example, countries like Japan and Germany would likely meet

these standards and thus have full free trade without producers from those

countries having to provide paperwork.

The statement of wages would show the average compensation for all

non-management positions employed by the producer, including contractors.

The importer would then be taxed based on how far those wages fall below

certain standards. What would end up happening is that there would be job

classifications, and those job classifications would have average wages

associated with them based on American wages. The difference between the average

American wage for that job classification and the average wage paid to the

foreign workers would be used to calculate your import tax. The tax would be

logarithmic so that the farther the foreign wages are from domestic wages,

the greater the percentage the tax is, eventually making it actually more

expensive to import from producers paying wages below a certain amount.

This would end up providing an incentive to raise wages at the point of

production, because from the importer's standpoint they are going to pay

roughly the same thing either way, they are either going to pay the money to

the worker in the form of passed-on wages, or they are going to pay the

money to the US government in the form of an import tax. Foreign producers

would then raise wages (to a point) as a way to attract business instead of

suppressing wages to do so.

There would also be an environmental and safety component, but this data

would probably end up having to come from more generalized reports where

industries from a region would be evaluated together. The total tax paid on

imported goods would be calculated based on a combination of the wage data,

environmental data, and workplace safety data. The more the wages,

environmental standards, and workplace safety practices are in line with US

standards, the lower the tax would be. Importing from countries with wages

and standards that exceed those of the US would of course result in no

import fees whatsoever.

The net effect of this on imports would effectively be the same as tariffs

in the short term, but the difference is that the long-term effect of such a

policy would be to encourage wage growth and environmental and safety

improvements in developing nations, instead of inhibiting them, as our

current policies largely do. Our current policies are filled with

contradictions, with some policies that offer incentives to foreign

countries to improve wages and working conditions, while other polices have

the opposite effect.

Given the fact that America enjoys ample trade with Japan and Europe, two

regions where compensation, regulations, and taxes are comparable to

America, or indeed exceed American standards, it's obvious that genuine trade

can exist when it is not driven primarily by drastically low wages and lack

of safety and environmental regulation. This is the type of trade that we

should be working to foster, not trade that drives a race to the bottom, as

our current system does.

Getting control of American trade, and encouraging improvements in

international working and environmental conditions, are essential first

steps in securing the American economy, genuinely improving the global

economy, and improving America's international standing among the citizens

of the world.

Fix Social Security

The first thing to understand about the Social Security system is that it

is not an investment system, it is an insurance system, and it operates like

an insurance system. It is designed to insure against disability prior to

retirement, to insure against the death of a primary provider for

dependents, to insurance against outliving your savings and investments, and

to insure against losses of savings and investments in retirement.

The first question to ask about the Social Security system, however, is is it

worth preserving at all? The answer to that is a resounding yes, and

provided below are the reasons why.

First of all, because the system is not market based it provides a

significant amount of stability to the American economy. The Social Security

system provides a significant counterweight to market forces, such that when

investments such as the stock market or the housing market crash or dip,

retirees still have at least some minimal stable form of income. This

stability has an effect on the entire economy, as seen below in the graph of

20th century business cycles, which can be seen to smooth out significantly around the

time that a significant number of people began drawing Social Security

benefits.

Secondly, the Social Security system is a fail-proof system. The system

is based on taxation of current income, so as long as people have income

there will be benefits to pay retirees. Even if those benefits do have to be

reduced for some reason, the benefits will never go away or be reduced

significantly, unlike investments, which can indeed go to zero.

Thirdly, the Social Security system, by virtue of the fact that it is

different from other aspects of our economy, and by virtue of the fact that

it isn't tied in with the stock markets, provides a type of economic

diversity to the economy. If we were to "privatize" the Social Security

system and move those assets into investment markets, this would just make

our economy less diverse and more brittle and more susceptible to shocks.

Fourthly, unlike an investment system, the federal government can borrow

money to make up short term deficiencies in the Social Security system if

needed, and this is a good thing. Obviously what has to be addressed is the

potential for long-term deficiencies, which are a bad thing, but as we shall

see, this isn't actually a problem.

Lastly, by virtue of the fact that the Social Security system is actually

an insurance program, not an investment program, it means that beneficiaries

actually get a larger benefit for a smaller cost. This is one of the big

misconceptions about Social Security. The Social Security retirement program is

actually funded through the OASI system, which is the Old-Age and

Survivorship Insurance program.

That's what Social Security really is, an insurance program that insures

against old age (in addition to disability and early death for surviving

dependents). Discussions of "return on investment" in regard to Social

Security completely miss the whole point of the program. It's not an

investment program, it's an insurance program. The "return on investment"

for Social Security varies wildly based on how long you live. If you only

live to be 60 years old, then your "return on investment" is zero, unless

your spouse or children claim your benefit, but if your children claim your

benefit it only goes to age 18, and if your spouse claims your benefit then

they have to give up their own benefit (you do this if your spouse's benefit

is greater). However, if you live to be age 105, then your "return on

investment" is huge, and its likely that you would also have exhausted any

savings you would have had by that point since most people can only

save enough, even with successful investing, to last them for 15-20 years of

retirement.

And that's entirely the point, this is "insurance", not an investment.

It's just like car insurance. If you pay $80 a month for car insurance for

15 years and you never file a claim, then what is your "ROI"? Obviously its

horrible right? You paid out $14,400 in insurance fees, and you got nothing

in return, other than "peace of mind" and compliance with the law. But, the

fact that you paid out $14,400 in fees and collected nothing is what allows

your fees to be $80 a month, because the losses, or costs, are averaged out

over all policy holders, so someone else may pay out $14,400 over 15 years

and end up "collecting" $100,000 in "benefits" if they have a major claim.

Their "ROI" in that case would be excellent. That's how insurance works.

In the case of Social Security, what you are insuring against is old age, investment losses,

and in the case of the disability and survivorship components of Social

Security, you are insuring against disability resulting in inability to work

before the age of retirement and against what happens if you die early and

leave dependents behind.

If you die early and you leave no dependents then you didn't use your insurance. If you die late then

you do. So the Social Security system works properly now, and is an

excellent complement to personal savings and investment. Not only is it a

form of insurance against out-living your retirement savings, but it is also

a form of insurance against retirement savings losses. It should not be

replaced with a different type of investment program, as those who call for

the "privatization" of Social Security call for. As with all other areas of

risk, the best approach is to have both savings and insurance. The same is

the case with retirement.

Having said all of that, there are real problems with the Social Security

system, but they are in fact relatively easy to address.

Currently American workers pay a roughly 12% income tax on the first

~$100,000 of payroll income. As a worker you see 6% come out of your pay

check, with your employer paying an additional 6% behind the scenes. The

self-employed pay the 12% directly.

The Social Security system faces two major problems. The first issue is

the fact that as the "baby boomer" generation retires there will be an

enormous burden put on the system. This was anticipated a long time ago, and

thus for the past 30 years Americans have been paying significantly more

into the system than was required to meet current payments in order to build

up the so-called Social Security Trust fund. The trust fund is a "reserve"

to be drawn upon to pay for the benefits of the baby boomer generation.

But what really is the "trust fund"? The money from the trust fund has

been borrowed by the federal government. In other words, when a dollar has

gone into the trust fund, the federal government has borrowed that dollar

from the trust fund, and issued an IOU to the trust fund. In order to repay

the IOUs, the federal government will have to raise money from general

taxation in order to repay the trust fund.

Sounds somewhat like a shell game, but it's really not much different than

how government bonds work either, where the government borrows money by

selling bonds, then has to repay those bonds with interest by raising the

money from taxation. The reality today, however, is that the money paid into

the trust fund has come entirely from middle income payrolls, since from the

beginning only payrolls up to a certain amount have been taxed by Social

Security. The taxes collected to re-pay the trust fund come primarily from

the federal income tax, which is more progressive than the Social Security

tax, and so contributions from low and middle income wage earners will be be

repaid by higher income tax payers.

But the real issue is, once the baby boomers start to retire, in order to

meet the obligations of Social Security, taxes will surely have to go up in

order to repay the trust fund, or the federal government will have to borrow

more money via bonds to do so.

There is good news to this actually, because the period for which the

baby boomers will put an increased demand on the Social Security system,

drawing down the trust fund, is a defined period of about 30-40 years, from

roughly 2010 to 2050. After that, the Social Security system will be able to

operate on a largely cash-in cash-out basis, with a very small reserve, thus

eliminating the problem of having to even deal with a trust fund. Not only

that, but once we pay out the Social Security benefits to the baby boomer

generation, that will also eliminate a significant portion of the federal

government's debt. You see, much of the federal government's debt is

actually debt owed to American retirees.

Even if we made no changes to the Social Security system today, the

"problems" of the Social Security system would effectively end with the

passing of the baby boomer generation, which is why talk about phasing the

program out for future generations makes so little sense. Future generations

aren't a problem for Social Security, only the upcoming retirees are. Once

the baby boomer generation passes, even with no other reforms, the Social

Security tax would be able to be significantly decreased. The Social

Security tax was increased purely for the purpose of building up the trust

fund, which won't be needed in the future. This is why the idea of paying

out Social Security for upcoming retirees and creating private accounts for

those under 30 makes no sense at all, since those under 30 aren't a

problem, it's the people between age 50 and 65 that present the biggest

challenge.

However, there is a problem with the way that current benefits are calculated.

One of the proposals by opponents of the Social Security system is to

reduce the benefits paid out to retirees and/or raise the retirement age for

drawing Social Security benefits. Raising the retirement age is a horrible

idea for multiple reasons, not the least of which is that all it would do is

increase unemployment programs. The reality is that what would really happen

is most people over 66 wouldn't be able to find a job so they would end up

just going on other forms of government assistance anyway, thus doing

nothing to reduce the overall burden on the federal government.

However, there is merit to reducing the benefit paid out by Social

Security, more specifically in changing how future benefits are calculated

so that they stop increasing above the rate of inflation.

Unfortunately this issue has become a hot-button topic among so-called

liberals, who generally oppose the idea of so-called "reducing" Social

Security benefits, but the reality is that the way benefits are currently calculated

is simply wrong, and it is wrong in such as way that it causes scheduled

benefits for the future to increase faster than inflation, meaning that as

of today, we are scheduled to pay out more to future retries in real terms

than we pay to current ones, which really makes no sense.

The reason for this is because the Social Security benefits are based on

"average-wage" indexing. This means that the base payment is adjusted by the

average wage for a given year. The problem here is that "average wages" are

determined by looking at all wages, including wages above the Social

Security taxation cap of roughly $100,000, so the "wages" of CEOs with

"wage" incomes of $5,000,000 a year get put into the average, even though

only the first $100,000 of that income is taxed to pay into the system. In

addition to that, there has been growing income disparity over the past 30

years, so while median wages have been essentially flat for 30 years, high

end wages have gone up, bringing the average up, causing benefits to rise

faster than the rates of the incomes that are used to actually pay into the

system. The problem with Social Security is that over the past 30 years

virtually all of the growth in the national income has been above the Social

Security cap, and has thus been exempt from the tax, so what has happened is

that a smaller and smaller portion of gross national income has been subject

to the tax with each passing year, while the benefits paid out grow faster

than the rate of inflation.

So, there are multiple things that can be done to "fix" Social Security:

- Index future benefit increases on the rate of inflation, not on

average wages

- Remove the cap on the Social Security tax, so that the tax will

apply to all income amounts

- Apply the Social Security tax to all forms of income, not just

payroll income

If these three steps are taken, the current 12% Social Security tax could

be reduced to roughly 5% or 6%, and more money would still be collected. By doing

this, it would not only insure the solvency of the Social Security system in

the future, but it would also make paying Social Security benefits for

current and baby boomer retirees more affordable. The overall result of

doing this would be a significant tax cut for the poor and middle class, and

a modest tax increase on those with high incomes.

Doing any one of these measures by themselves would be helpful, but doing

all of them together is what allows the overall Social Security tax rate to

be dramatically reduced, while still meeting the current benefit levels of

the Social Security system.

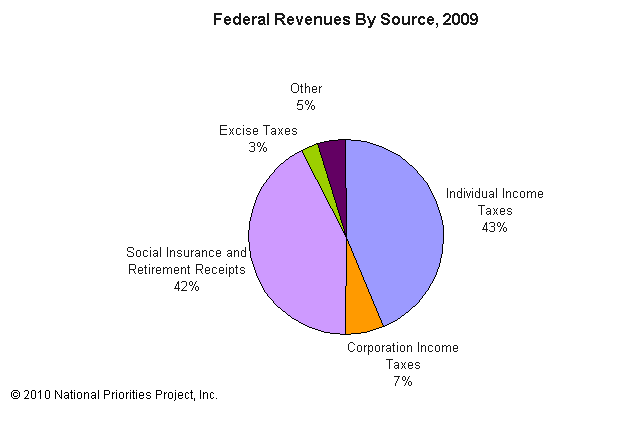

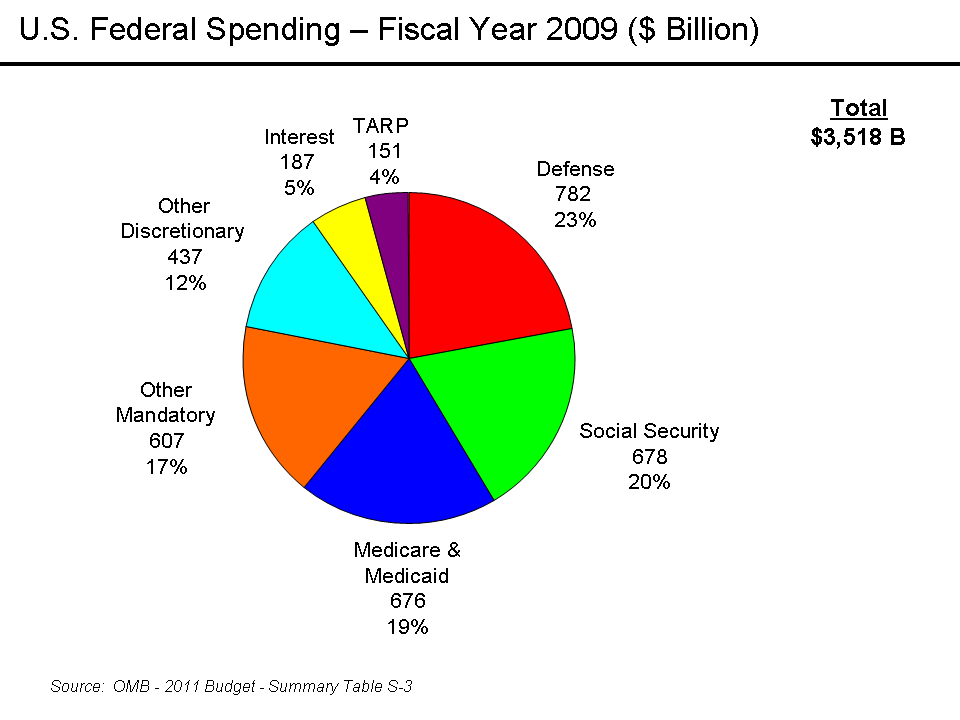

If we look at the tax receipts for 2009 we see that receipts from Social

Security taxes roughly equals the tax receipts from individual income

taxes, and the Social Security taxes are regressive, placing the burden

almost entirely on the poor and middle class. This is why the cap on the

Social Security tax should be eliminated and the overall tax rate reduced.

source:

http://www.nationalpriorities.org/node/6919

For more on Social Security see:

The Truth

About Social Security

Getting a grip on Social Security: The flaw in the system

Implement a National Individual Investment Program

The objective of the National Individual Investment Program would be to

ensure a more equal distribution of capital ownership in America, and to

allow the American economy to become increasingly less dependent upon labor,

so that an increasing amount of national income can go to capital instead of

labor, without leading to growing income inequality or economic unfairness.

Today we face a situation where increasing amounts of production are capable

of being automated by computers and machines, but because the vast majority

of people depend on wages from working for income, efficiency increases

actually lead to economic problems because as efficiency increases fewer

people are needed for production, which contributes to unemployment, which

then reduces overall incomes, which reduces demand for goods and services.

This circular feedback problem can only be solved within a capitalist

framework by ensuring that capital ownership is widely distributed and that

the entire population receives a growing portion of their income from

capital investment.

The single greatest root cause of economic and political problems in

America today is concentration of capital ownership and control, and the

growing economic disparity which results from it. The natural tendency

within an industrialized capitalist economy is for capital ownership to

become increasingly consolidated and concentrated, and yet this

concentration of capital ownership ultimately undermines the entire economy,

which is exactly what we are seeing in America today.

Share of capital income received by top 1% and bottom 80%, 1979-2003

source:

http://sociology.ucsc.edu/whorulesamerica/power/wealth.html

The incomes of the wealthiest people in America, and around the world,

are

overwhelmingly from investment income, i.e. a product of capital ownership.

Roughly 50% of the personal income of those in the top 1% comes from

investment income, and yet essentially all investment income is a product of

"other people's work". That investment income represents in real terms,

redistribution of wealth from poor and middle-class workers in America and

around the world, to the wealthy.

When the United States of America was founded it was the most egalitarian

Western nation in the world, with the exception of slavery. For free

citizens of European dissent, America was the most egalitarian country there

was. Without getting into issues of racism, slavery, Chinese labor, etc., it

is still important to understand why America had such a relatively

egalitarian system among the free white citizens and how and why that

egalitarian economy system has changed.

The reason that the American economy was so egalitarian initially was

that America had an agricultural economy, where 85% of Americans were

farmers, making land the primary form of capital in America, and land was

effectively free. (After it was taken from the native population)

The policies of the United States for the first 100 years of our

nation's existence, were to acquire land by whatever means, using government

power to do so, and then to redistribute that land to the free citizens at

little or no cost to the citizens. The reason that this was the policy is

that there was a relatively small population living on a large land mass,

and the government wanted to encourage immigration in order to populate the

country and to encourage people to make productive use of the land, i.e.

"available capital".

What this means is that people were able to acquire significant capital

in America for very little personal cost, since it was abundant and it's

acquisition was subsidized by the government, and as a result 90% of the

free American population owned and controlled their own capital, and thus

capital ownership in America was the most egalitarian of any major nation in

world history. What made America great was the relatively equal distribution of

capital ownership, while in places like Europe, China, Japan, India, etc.

land ownership was largely concentrated in the hands of aristocracies and

religious organizations.

However, obviously the "free land" couldn't last forever, as eventually

the nation became relatively highly populated and patterns of ownership

developed, thus the land available to just give to people for little or

nothing disappeared. In addition, around the same time, immediately following the Civil

War, industrialization began. With industrialization land was no longer the

primary form of capital. The American economy changed from an agricultural

economy, where almost everyone owned and controlled their own capital, to an

industrial economy, where fewer and fewer people owned their own capital and

more and more people became wage laborers.

This is when economic disparity began to dramatically increase in

America. That process has continued on for over a century now. The first big

shift came at the turn of the 20th century, when many people left farming to

work in cities. But, even with this change small businesses remained a

prominent part of the American economy. There were fewer farmers, but there

were still a large number of individuals and families that owned their own

stores and businesses. Small business ownership remained fairly steady,

though it was continuously declining up to the 1980s, when it began to

dramatically decrease due to the rise of large national chains, "big box"

stores, and the outsourcing of manufacturing to foreign countries.

As is the natural tendency in a capitalist economy, capital has become

concentrated over time. Capital ownership was once widely distributed in

America, and over time it has become increasingly consolidated. This pattern

of capital ownership consolidation has taken place in every industrialized

capitalist economy around the world, and different countries have reacted to

it in different ways. The point of the Socialist and Communist movements was

to address the problems raised by this tendency toward capital ownership

consolidation within capitalist economies, but for a wide variety of

reasons, these movements have failed to deliver on promises of fairness and

economic prosperity. Yet, in many ways, the approaches taken even in

moderate capitalist welfare-state economies, such as are common throughout

Europe, follows the line of thinking set out by the socialists.

This approach generally takes three tracts: nationalizing certain

segments of the economy, using heavy taxation to re-distribute the wealth

that was re-distributed from the workers to the capital owners back to the

workers, and limiting the growth of capital in order to preserve the roles

and compensation levels of workers.

There are significant problems with these approaches however, and yet,

something has to be done to address the issue of concentration of capital

ownership and the fact that capital ownership is a means of re-distribution

of value from workers to capital owners.

This is where a national investment program comes in. The way it would

work is that the government would distribute shares in a total market index fund

to virtually everyone in the country. The shares would be paid for via a

dedicated income tax, similar to how Social Security is done now. The tax would be

a defined flat tax of roughly 8%, with the first $30,000 of income being

exempt. Shares would be paid out based on the number of hours an individual

worked, with a cap of 2,080 hours a year (40 hours a week over 52 weeks).

The cap would be applied on a yearly basis so that those who work overtime

in seasonal jobs would not be unduly penalized. Salaried employees would be

counted as working 40 hours a week.

Someone with a total income of $50,000 a year would pay $1,600 in

taxes and, assuming that they worked 40 hours a week all year long, and

given the national income from 2007 of $12.5 trillion, they would receive roughly

$3,500 back in the form of shares. Someone with an income of a million

dollars a year would pay $68,600 taxes and, assuming that they also worked

40 hours a week, or were salaried, they would get the same roughly $3,500

back in the form of shares. Someone with an income of a billion dollars a

year would pay $79,997,600 in national investment taxes and also get the

same $3,500 back in the form of shares, assuming that they worked full-time.

The break even point, using these figures (which may need to be adjusted)

would be around an income of $75,000 a year (adjustments could be made to

move the break even point up if needed). At that income level someone

working full time would receive about $3,500 a year in shares and pay about

$3,500 in National Individual Investment Program taxes. It is important to note here that the

benefit would not be a defined benefit, the way that Social Security currently

is, it would fluctuate based on the

economy. The tax would be constant, and the amount of the benefit received

would go up and down based on the amount of revenue collected from the tax.

Thus the program would never run a surplus or a deficit.

Who would get shares, and how?

- Everyone would get a starting amount of shares when they are issued

a Social Security Number; for most this would be at birth. You would

receive 1,040 hours worth (half a full time year) of shares when you get your SSN.

- When you graduate high school you would get 2,080 hours worth

(a whole full time year) of shares.

- Workers would receive shares based on the number of hours they

worked, with full time salaried workers receiving credit for 40 hours a

week. A full-time worker would receive about $3,500 worth of shares a

year based on current national income levels. Benefits would be capped

at 2,080 hours a year.

- People who are of working age, but who cannot work due to

disability, would receive 1,040 hours worth of shares a year.

- Non-citizens working in the US would still have to pay the tax, but

would not receive the benefit.

The shares would be credited to an account on a monthly basis, or perhaps

some scheme would have to be developed to credit them in an evenly

distributed manner so as not to have huge purchase blocks at the same time

every month.

Prior to turning 18 years old the shares would be held in trust and could not be

accessed by you or your parents. Once you turn 18 the shares would be yours

to do with as you wish and would be treated like shares in a normal mutual

fund. The national whole-market index fund would be held and managed by the

federal government in order to reduce the costs of administration. The index fund would pay out a dividend based on the market,

like a normal fund. Income from dividends or the sale of shares would be

normal taxable events. Individuals would be allowed to transfer their shares

to accounts held at private institutions if they wished, and would be

allowed to exchange them for qualifying private mutual funds, bonds, money

market accounts, stocks, etc., as non-taxable events.

Importantly, this would not be a retirement account, these shares

would be accessible by individuals the moment that they are issued, from 18

years of age on.

What a national investment program like this would do, is it would ensure

that every working citizen, and those that can't work due to no fault of

their own, would share in the growth of the economy. It would ensure that

everyone could, and actually would, become capital owners. This is a means

of ensuring a more fair distribution of capital ownership, while working

within the traditional capitalist framework. Capital ownership would remain

private. This would also stabilize the economy by ensuring that all workers

would have increasing levels of investment income. By doing this, income

from wages would become increasingly less important to the economy, though

still the dominate form of income for the foreseeable future, which would

mitigate the impact of unemployment events and reduce the burden on other

government assistance programs, such as food stamps and housing assistance,

etc. This program would lay the foundation for developing an economy in

which income from capital would become an increasing portion of national

income, without leading to increased income inequality, which is essential

for promoting greater growth and economic efficiency.

Federal Tax reform

Individual income tax reforms

The federal taxation system of the United States is quite a mess. It is

too complicated, there are too many loop holes, and it isn't nearly

progressive enough. What most Americans fail to realize is that when you

take the entire tax burden into account, the America taxation system is

already essentially a flat-tax system. Yes, the national income tax system

as applied to "earned income" is moderately progressive, but there are

multiple loop holes in the earned income tax system. Capital gains taxes are

effectively flat and lower than income on high wages while higher than income

on low wages, sales taxes are regressive in their effect, as are

registrations and "user fees" generally, and some states actually have flat

or regressive income taxes as well as property taxes that can be flat or

regressive. And the largest taxes that the poor and middle class pay are the

payroll taxes for Social Security and Medicare, of which the Social Security

tax is distinctly regressive.

One of the major sources of complication and rift in the federal taxation

system is the varying classifications for different forms of personal

income. There are different taxes applied to "earned income" (wages) vs.

"unearned income" (investment), different taxes applied to capital gains vs.

income from dividends, different taxes applied to gift income and

prize income, as well as income from inheritance, etc.

The first step is to eliminate all of these different classifications and

just treat all income the same. Yes we can finally get rid of the so-called

"death tax", just eliminate it and treat inheritance the same as normal

income.

The second step is to eliminate virtually all personal income tax

deductions. The only deductions that should remain are deductions for

contributions to charities and contributions to retirement accounts. That means eliminating the home interest deductions, the student loan interest deductions, the child tax credit,

the various deductions for this or that type "green" investment, etc.

In conjunction with steps one and two the entire personal income taxation

structure would have to be completely revised. The various deductions should

essentially become baked into the overall taxation levels.

Today, for example, earned income from $0-$8,375 is taxed at 10%, and

income from $8,374-$34,000 is taxed at 15%, yet the effective federal income tax

rate for someone with an income of $25,000 a year is actually below 10%.

Likewise, income over $373,650 is taxed at 35% currently, yet people with

incomes of half a million dollars a year can have effective earned income

tax rates around 20%, even though the tax rate on income over $34,000 is

25%.

This all stems from years of special interest groups trying to get

various advantages for themselves written in to the tax system, as well as

genuine attempts at trying to "guide" the market with incentives to make

things like buying a home more affordable, etc. But generally, the income

tax code is a very poor way to try and manipulate the markets, which is what

all of these deductions amount to, attempts to manipulate markets.

Furthermore, these types of deductions can actually do harm and undermine

markets as well as being unfair in their application.

For example, the home interest deduction, while intended to help

Americans afford to own a home, ends up being an unfair tax increase on

people who can't afford to own a home or simply don't want to. The reality

is that most Americans who don't own a home are poor

and/or retired. Since the overall budget is in deficit, it means that

regardless we will have to raise a certain amount of taxes, so if we are

giving cuts to some people it means by definition that others have to pay

more to make up the difference. In reality every tax deduction can be seen

as a tax penalty on those that don't get the deduction. In the case of the

home interest deduction, this basically means that we penalize the poor and

the elderly for not owning homes.

But it's worse than that, because ultimately the home interest tax

deduction ends up affecting the market itself, so that this tax deduction

gets incorporated into the price of a home, so that in reality the deduction

doesn't make homes any more affordable, all it does is cause the price to go

up by the amount of the deduction, so it actually makes homes less

affordable because the initial purchase prices are inflated beyond the

normal market values due to the tax code. The same goes for education, etc.

What happens is that credit becomes subsidized by the government, and then

the subsidized credit just causes inflation.

Now, of course, eliminating these types of deductions would not be easy,

especially in the current economy. Eliminating the home interest tax

deduction would cause home prices to fall further, which ultimately needs to

happen, but not now and not in an uncompensated way. So, what I would

propose is actually a phased federal government buyout of tax deductions.

Elimination of tax deductions would be phased in over 5 years, with tax

payers getting a payment each of those five years for the reduced amount of

their tax deduction.

The way it would work is that the new tax system would be phased in over

5 years. Assuming that your income was the same over the five years what

would happen is that the amount your taxable income would be reduced by

deductions would go down every year, meaning you would pay taxes on a larger

and larger portion of your income every year over those 5 years. However,

depending on your tax bracket, your overall tax payment should stay about

the same, because while your deductions would go down, so too would the tax

rate. Instead of being taxed at 25% income tax rate, and then using

deductions to bring that down to an effective 15% tax rate, your tax rate

would just get lower and lower each year until it reached around 15% with

zero deductions at the end of five years. However, for people with student

loans and home mortgages, they would get additional payments on top of any

potential tax returns, for the amount that they would have been able to

deduct under the old system, each year up to the end of the 5 years. This

would compensate home owners for the loss of home value due to market

correction for the loss of the deduction, and it would compensate people

with student loans for the inflated prices of their loans, which they could

use to pay down those loans.

The restructuring of the personal income tax system around the

elimination of distinctions between different types of income and the

elimination of virtually all deductions would also involve major restructuring of the

income tax brackets themselves. Determining the exact brackets and tax

amounts would require a full analysis of the budget and national income

details, but generally the federal income tax needs to be much more

progressive and needs several additional tax brackets on the high end.

The current tax brackets for 2010 are shown below:

| Marginal Tax Rate |

Single |

| 10% |

$0 – $8,375 |

| 15% |

$8,376 – $34,000 |

|

25% |

$34,001 – $82,400 |

|

28% |

$82,401 – $171,850 |

|

33% |

$171,851 – $373,650 |

|

35% |

$373,651+ |

Keep in mind that the tax brackets above are based on the existence of a

large number of available deductions. The tax brackets that I propose are as

follows, and again would need to be tweaked based on real budget and income

analysis:

| Marginal Tax Rate |

Single Filer Income |

Total Paid w/o Deductions

at Marginal Limit |

Total Income Tax Rate

at Marginal Limit |

| 0% |

$0 – $25,000 |

$0.00 |

0.00% |

| 10% |

$25,001-$50,000 |

$2,499.90 |

5.00% |

| 15% |

$50,001-$100,000 |

$9,999.75 |

10.00% |

| 20% |

$100,001-$250,000 |

$39,999.55 |

16.00% |

| 25% |

$250,001-$500,000 |

$102,499.30 |

20.50% |

|

30% |

$500,001-$1,000,000 |

$252,499.00 |

25.25% |

|

35% |

$1,000,001-$10,000,000 |

$3,402,498.65 |

34.02% |

|

40% |

$10,000,000-$100,000,000 |

$39,402,498.25 |

39.40% |

|

45% |

$100,000,001-$500,000,000 |

$219,402,497.80 |

43.88% |

|

50% |

$500,000,001+ |

N/A |

~49.00% |

What this shows is that, for example, someone with $100,000 of income

would pay a total of $9,999.75 in personal income taxes, which comes out to

10% of their income.

There are important things to remember here. The first is that there

would be virtually no deductions, with the exception of deductions for

charitable giving and deductions for retirement account contributions. The

second is that federal income taxes are not the only federal taxes paid on

income, and there are also state taxes on income as well.

The other current major taxes on income are Social Security and Medicare

taxes. The Social Security tax is currently around 12% on the first ~$100,000

of payroll income (employees pay 6% and the employer pays 6%), and the Medicare/Medicaid tax is around 3% on all payroll

income. Based on the changes that I'm proposing to Social Security, the

Social Security tax would drop to around 6% on all income (there would be no

employer contribution), and the

Medicare/Medicaid tax would stay about the same, but be applied to all

income, not just payroll income.

In addition, the National Individual Investment Program tax would be

around 8% on all income over $30,000, however you would also be getting

shares back worth around $3,500 a year (based on current national income

levels) in exchange for that 8% tax on income.

The resulting total federal taxation rates on all income are shown below.

This is what the total income tax rate would be, with no deductions, for

someone with the maximum income for each of the brackets below, taking into

account the income tax, Social Security tax, Medicaid/Medicare taxes, and

both the National Individual Investment Plan tax and return compensation.

|

Single Filer Income |

Total Marginal Tax Rate |

|

$0 – $25,000 |

7.02% |

|

$25,001-$50,000 |

18.88% |

|

$50,001-$100,000 |

30.14% |

|

$100,001-$250,000 |

38.97% |

|

$250,001-$500,000 |

47.45% |

|

$500,001-$1,000,000 |

54.46% |

|

$1,000,001-$10,000,000 |

55.92% |

|

$10,000,000-$100,000,000 |

57.29% |

|

$100,000,001-$500,000,000 |

63.46% |

|

$500,000,001+ |

~67.00% |

This would be a net tax cut for people with incomes of roughly $200,000 a

year and less, a moderate tax increase for those with incomes of around half

a million dollars, and a significant increase for those with incomes

over a million dollars a year.

By eliminating the various different types of income taxes, i.e. the separate

tax on wages, on capital gains, on dividend income, on gifts, on

inheritance, etc., it makes the entire income tax system progressive and

eliminates issues with things like raising taxes on dividends eating into the

income of low and moderate income retirees, etc. What this would also do, is

it would facilitate broader capital ownership. Currently, the poor and

middle class can pay higher taxes on their capital gains than they do on

their wage income, which provides a disincentive to investment, while those

with high incomes pay lower taxes on capital gains than they do on wage

income, which of course provides a further incentive for concentration of

capital among the wealthy. By treating all forms of income the same, the

incentives for concentration of capital in the hands of a few would be

significantly reduced. In addition, the implementation of a National

Individual Investment Program would result in a growing portion of the

nation's income being realized via capital income, which means that without

eliminating the distinctions between payroll income and investment income

the income tax system would become increasingly ineffective. Facilitating an

expansion of capital income necessarily requires eliminating the differences

between capital and wage income.

Create new type of corporate entity

There is some argument to be made for reducing corporate taxes in the

United States. Corporate taxes are at least one of the reasons that

companies chose to move production over seas. However, corporations should

pay taxes, because corporations are distinct entities which make use of and

benefit from public resources. Corporations clearly are beneficiaries of

public education systems, public infrastructure, financial regulation and

support, etc., etc. the list goes on and on.

So, while there is a case to be made for reduced taxes, these reductions

should come with conditions. New types of corporate legal entities should be

created which would be defined legally differently than current

corporations. These legal entities would not be recognized as persons,

as

current corporations are, they would not have the same rights under the

Constitution as persons, they would not offer the same types of protections

to owners and executives that current corporations do, and these

corporations would not be allowed legally to lobby the government or make

any campaign contributions to politicians.

But, these corporations would by law always pay half of the corporate

taxes that normal corporations do.

These limited types of corporations would not be allowed to be owned by

normal types of corporations nor would they be allowed to own normal

corporations. This would be to prevent parent corporations from setting up

tax shelter subsidiaries, or lobbying subsidiaries, etc.

These entities would have to be designed in such a way that wasn't

completely onerous so that companies would actually want to organize under

in this way. What this would do is it would create a market force against

lobbying and undo government influence by corporations. Is it more

profitable to lobby the government or if it better to just pay lower taxes

and move on with business? If competitors in an industry switch to the new

type of entity that could provide and competitive advantage, encouraging

others to follow suit, etc.

This would address the issue of both reducing corporate taxes and

reducing the influence of corporations on the government, while not forcing

anyone to do anything. The adoption of the new type of entity would be a

matter of choice.

Real health care reform

The health care reform legislating signed into law by Barack Obama,

a.k.a. Patient Protection and Affordable Care Act, falls far short as a plan

to reduce health care costs, improve health care delivery, and make health

care more accessible.

The most significant failing of the Patient Protection and Affordable

Care Act is that it completely fails to address the root causes of America's

excessive health care spending. The Patient Protection and Affordable Care

Act focuses on "health insurance reform", but health insurance isn't the

root cause of America's health care problems. It is one of the components of

the problem, but it isn't the root cause. The root causes of America's

health care overspending are firstly the American lifestyle and secondly the

overall for-profit manner in which the health care system operates.

Before laying out a health care reform proposal it is first important to

establish the philosophical underpinnings of how health care should be

provided and paid for in a modern civil society. It is my view that there

are basically two factors which contribute to an individual's health care

needs during their lifetime, things that an individual can do nothing about,

and things that an individual is responsible for.

The things that an individual can do nothing about are their age and

their biology. The things that an individual can do something

about are the lifestyle choices that they make and activities that they

engage in. In other words, the types of foods they eat, their exercise

habits, the types of high risk activates that they engage in, etc. In

addition to these things there is one other aspect of health care risk,

which is an individual's occupation. Technically this is a choice of the

individual, but due to the fact that for the sake of society high risk jobs

still need to be done, these types of risk have to be treated differently

than other lifestyle risks, and will also be addressed.

My view is that every individual in society should pay the same costs for

insuring the risks associated with the things that they cannot control, and

that individuals should personally pay a premium for risks associated

with their own lifestyle choices.

What then, would be the best way to implement a system where everyone

paid an equal amount for the base coverage of non-lifestyle related medical

care, while being able to charge a premium for lifestyle choices that

increase an individual's risk of requiring medical care?

The best way to do this would be via a single payer system, where

everyone under age 65 is charged the exact same amount for coverage per

year, and where fees on goods and services

would be charged at the point of sale of such goods and services. This

proposal would eliminate Medicaid (public insurance for the poor) altogether and bring those on Medicaid

into the same health insurance pool as everyone else under age 65. Medicare

would be preserved, for now, as a system for those who are retired.

This means that if you were to take all health care expenses for people

under age 65 and subtract out expenses related to specific lifestyle choices

and activities, such as lung cancer cases in smokers, broken legs among snow

boarders, heart disease and diabetes among the overweight, etc. then you

would arrive at a base cost for medical care, and if you divide that among

all of the people under age 65 in America you arrive at an average health

care cost per person per year. Granted defining exactly what people can

control and what they can't can be challenging, for example: people's weight

is a factor of both their eating habits and genetic predispositions, but

some reasonable determination can be made.

Under the single payer system, every individual would have to sign up for

a federal health insurance plan. The cost of the plan would be the same for

everyone, roughly $2,000 per year per person based on current health care

costs. Children and dependents would be covered by a head of house hold, so

it would work just like private insurance does now in that regard. An adult

would have to add their children to their insurance plan. The adult would

then pay the additional amount for coverage of the child, in this case an

additional $2,000 per child. Spouses could chose to have their coverage

under their partner's plan, meaning that the partner would pay, or they

could have their own individual insurance.

There would only be one plan in terms of coverage, but there would be

three pricing structures based on your income. Those with income at or below

the poverty level would qualify for free coverage, those with incomes up to

2 times the poverty level would quality for a reduced rate.

Payments would be setup to be paid voluntarily via monthly bills, but

those who were behind on payments by 6 months or more could have their pay

garnished by the federal government in order to stay current.

However, funding for the federal health insurance program would only come

partly from the base federal rate that everyone would pay. The remainder of

the funding would come from the insurance risk fees applied to goods and

services. The way that this would work is that state level actuaries would

determine the risk associated costs with the consumption of goods and

services in their state, at a state level, and then those fees would be

collected at the point of sale for each of those goods and services, much

the same way that sales tax is collected today.

This would require investments in technology and it would require

development of new point of sale systems, which would be able to charge these

fees. The fee rates would be published once a year and could be updated just

once a year in point of sale systems. The primary subjects of the fees would

presumably be (would actually have to be determined by actuaries) foods and

beverages, tobacco products, sporting equipment, entertainment vendors (i.e.

fees could be associated with ski lift tickets, or white water rafting

events, etc.). If this proved to be overly difficult, these insurance fees

could be charged at the wholesale level, so that they would be paid by

retailers up front and passed on to consumer, instead of being paid directly

by consumers, or barring that, they would be applied as a VAT (Value

Added Tax) style tax, however the preference would be to charge these fees

at the point of sale to consumers.

The beauty of a system like this is that it both makes it possible to

accurately charge people for the real health care related risks that they

are taking, and thereby the likely costs that they will incur, and it also

serves as a way to price in the true cost of consumption of goods and

services up front, so that people can make more informed decisions and

better choices.

For example, if you buy one type of potato chips and you get charged a

30% insurance fee on it when you check out, you may think twice about

consuming that product in the future and look for an alternative with a

lower, or with no, additional health insurance fee added to it. And by doing

so, you would be reducing your risk of future health problems, and thus

actually reducing the burden on the overall health care system and reducing

the cost of health care in the country. On the other hand, there is nothing

to force you to do that, so if you chose to keep eating the bad chips you

can, but you will be paying appropriately for your likely future health care

costs, instead of pushing those costs off on to other people.

People who don't buy a lot of junk food won't pay much in additional

fees, and people who do will. It isn't being a "nanny-state", it is simply a

matter of more accurate pricing. This approach actually enhances the power

of markets, it doesn't try to hinder them. The reality is that right now

markets aren't working in people's lifestyle choices because the true costs

of consumption choices aren't known up front and isn't fully factored into

buying decisions. By placing the full cost up front, it allows the markets

to be more accurately representative of the choices that the consumer is

actually making. And the important thing to note here is that this type of

system could only be implemented with a true single payer health insurance

system.

Junk food could be taxed without using a single payer system, but the

overall approach would have to be crude, and ensuing that those taxes were

used to pay for health care costs would be more difficult. With a single

payer system the fees can be appropriately set by actuaries via the use of

studies and provider reporting, and the fees can be a direct component of

paying for health care, thereby directly offsetting the cost of

insurance for everyone.

One area of concern here is the potential impact on the poor, who overall

are larger per-capita consumers of junk food and tobacco products. This

should not be a concern, since the poor will be paying a lower rate for

their base coverage, and since the objective here is to change behavior, and

thus the preferred outcome would be to reduce the rate of smoking and junk

food consumption among the poor.

The third component of the single payer coverage system is that of

employer contributions. Overall, the cost of health insurance to employers

would go down dramatically under this system, as most of the costs would be

shifted to individuals, under the umbrella of the federal government. But as

mentioned initially, there are three major components to an individual's

health care risks, their inherited biology and age, neither of which they

can do anything about, their lifestyle choices, i.e. the goods and services

that they consume, and the third component is workplace related risks. It

is simply a fact that working in a coal mine is harder on one's health than

working as a sale's clerk. Employers would be required to pay into the

single payer system based on the type of work performed and the associated

risks. This would be accomplished by using the existing worker's

compensation classification system. Employers would not only pay rates set

by actuaries for worker's compensation insurance, but they would also pay

fees based on those same job classifications, using independent rates for

general health insurance, into the single payer health care system. Worker's

compensation insurance covers medical costs for employees who are injured in

the course of employment. The employer contribution to the single payer

health insurance fund would cover health risks related to the line of work,

other than the risk of injury on the job, such as long-term health risks and

indirect, but associated health risks, for example the risk of lung cancer

for employees who work in smoking environments, etc. If you work in a bar

for 10 years and then then 10 years after you worked in the bar you develop

lung cancer, that isn't covered by worker's compensation insurance. An

additional fee for workers would go toward covering those types of risks.

The important thing to note here is that employers would then only be

paying for the portions of risk associated with the work being performed by

the employees, as opposed to the way in which employers now often pay for

the entire health care policy or for some portion of the policy based on

what the employer feels it can pay or what unions demand they pay, etc. The

portion paid by employers under this system would essentially always be

less than what paying for full coverage costs currently, and some employers

would likely pay nothing at all. Jobs that have no special health risks

associated with them would have no health insurance fees either.

A system like the one proposed here would have many advantages over the

current health insurance system. For one thing it would be cheaper for

employers overall, thereby increasing American global competitiveness.

Secondly, such a system would completely eliminate problems associated

with "genetic discrimination", a mounting potential problem in the area of

health care and health insurance. By adopting a single payer system, and by

shifting the cost of increased risk based on individual choices to the

point of sale, numerous potential privacy issues are avoided. With a single

payer system that charges a flat base fee to everyone, the potential for

misuse of genetic information or of potential ethical problems with the use

of genetic information by insurers is eliminated. This is important because

there is a real risk that both growing genetic information could undermine

the entire private insurance system, and that the advancement of genetic

screening for use in potential treatment and preventative care could be

negatively impacted due to the potential for such information to undermine

the long-term economic interests of patients by making them "uninsurable" in

the private market if such information indicates that they carry high-risk

genes. This would also mean that the issue of pre-existing conditions would

go completely out the window. It's not that you would no longer be denied

coverage for pre-existing conditions, the issue of pre-existing conditions

would simply cease to exist altogether.

Thirdly, by completely separating individual coverage from employers,

this provides many benefits for individuals. This would mean that your

insurance would no longer be tied to your job, and you would no longer have

to worry about losing your insurance if you lost your job or changed jobs.

It would also eliminate the potential for employer discrimination based on

medical conditions, because the employer would no longer have any direct

financial incentive to discriminate, as they do now. Currently, since

individuals with medical problems can cause rates to go up for the entire

insured workforce, employers have an extra incentive to discriminate based

on medical conditions. Not only that, but they also have incentives to

monitor employee's behavior and to infringe on employee privacy in the name

of controlling health care costs, for example holding anti-smoking polices

that make smoking, even outside the workplace, grounds for termination.

Fourthly, by having a universal single payer system, one of the most

complicated and wasteful aspects of the health care system could be

eliminated, which is the complication of dealing with filing insurance

claims and the processing of payments. The America system of payment

processing is the least efficient in the industrialized world, because of

the maze of private insurers that we have in America, each of which uses

different systems for processing, has different rules, different paper

work, etc. The diversity of insurers is a barrier to standardization, while

a single payer system would be able to provide highly standardized and

predictable systems of payment and claims processing.

Fifthly, by having a universal single payer system individuals would no

longer have to worry about changing insurers when moving to different

locations, and insurers would be able to become much more familiar with the

use of their insurance. Health care providers would also, due to having one

single standard and set of rules, be able to know exactly what the coverage

guidelines were for treatment, etc.

While many other reforms are also needed in terms of health care

delivery, equipment and drug costs, etc., what I'm presenting here is

just a framework for meaningful insurance reform, that not only changes

health insurance itself, but which also addresses the root causes of

America's out of control health care costs. By incorporating risk related

pricing to the consumption of goods and services at the point of sale, not

only does the system become much more fair by ensuring that individuals more

accurately pay for the risk burdens that they place on the system, but it is

also reasonable to expect that such a system would allow and encourage

people to make better lifestyle choices, resulting in an overall reduction

in demand for health care services, by reducing unhealthy lifestyle choices

in the first place. And thus the system is not just a system designed to pay

for health care, but a system designed to reduce the demand for health care

as well.

Increased funding for Medicare

With the elimination of Medicaid and the rolling of Medicaid recipients

into the general insured population, Medicaid funding would go away as would

the taxes used to support Medicaid. As for Medicare, the Medicare tax is

currently only applied to payroll taxes, it does not apply to other forms of

income. As with other similar proposals, the proposal here would be to apply

the Medicare tax to all forms of income, not just payroll taxes. This would

increase funding for Medicare and address the long-term solvency issues. In

addition, with the implementation of insurance fees at the point of sale for

goods and services that contribute to increased medical risks, obviously

some of these goods and services would be purchased by seniors and thus

seniors would be paying these fees. Not only that, but due to the fact that

some health effects from lifestyle choices don't manifest themselves until

old age, it is furthermore appropriate that Medicare receive a portion of

the revenue generated from the point of sale fees.