|

How Reagan Sowed the Seeds of America's

Demise

By

- March 30, 2010 - March 30, 2010

It has been over a year now since "The Great Recession" officially began,

and yet even a basic understanding of the real causes of America's economic

problems has still not emerged in the public. Indeed new movements have

emerged touting as solutions to our current economic problems many of the

very policy ideas that are actually the causes of our current economic

problems. The rallying cry of conservatives across America has been a

"return to the policies of Reagan!" The claim of many American conservatives

has been that Ronald Reagan faced similar economic conditions when he was

elected, and he was able to turn the economy around, so we need to return to

the principles he used to reinvigorate the American economy.

The reality is that the economic policies of the "Reagan Revolution" have

been in effect for the past three decades, and it is these very policies

that have caused the economic situation that America finds itself in today.

During his first

presidential campaign Ronald Reagan campaigned against government spending, he

campaigned on reducing the national debt, he campaigned for individual

responsibility, and he campaigned for broader American capital ownership.

The effects of his policies, however, had all of the exact opposite

effects, and yet amazingly even today the vast majority of all Americans,

especially conservatives, still believe Reagan's rhetoric and not the real

effects of his policies.

In 1980 Reagan campaigned against what he called "out of control" deficit

spending by the federal government. He identified the source of this "out of

control" spending largely as social welfare programs. Shortly after taking

office in 1981 Reagan gave a televised speech to the country in which he

stated:

"By 1960 our national debt stood at $284 billion. Congress in 1971

decided to put a ceiling of 400 billion on our ability to borrow. Today

the debt is 934 billion. ...

Here you see two trend lines. The bottom line shows the increase in tax

revenues. The red line on top is the increase in government spending.

Both lines turn upward, reflecting the giant tax increase already built

into the system for this year 1981, and the increases in spending built

into the '81 and '82 budgets and on into the future. As you can see, the

spending line rises at a steeper slant than the revenue line. And that

gap between those lines illustrates the increasing deficits we've been

running, including this year's $80 billion deficit. Now, in the second

chart, the lines represent the positive effects when Congress accepts

our economic program. Both lines continue to rise, allowing for

necessary growth, but the gap narrows as spending cuts continue over the

next few years until finally the two lines come together, meaning a

balanced budget. I am confident that my administration can achieve that.

At that point tax revenues, in spite of rate reductions, will be

increasing faster than spending, which means we can look forward to

further reductions in the tax rates....

Our aim is to increase our national wealth so all will have more, not

just redistribute what we already have which is just a sharing of

scarcity. We can begin to reward hard work and risk-taking, by forcing

this Government to live within its means. Over the years we've let

negative economic forces run out of control. We stalled the judgment

day, but we no longer have that luxury. We're out of time. ...

We can leave our children with an unrepayable massive debt and a

shattered economy, or we can leave them liberty in a land where

every individual has the opportunity to be whatever God intended us to

be. All it takes is a little common sense and recognition of our own

ability. Together we can forge a new beginning for America."

-

Ronald Reagan: Address to the Nation on the Economy, Feb. 5, 1981

The irony of this speech is that the national debt was not out of control

at all in 1981, in fact the national debt was at the lowest point it has

ever been since World War II in 1980. In the speech Reagan cited national

debt figures in raw dollar amounts, unadjusted for inflation and not tied to

GDP. Those figures are essentially worthless and no economist would ever use

them as a measure of the national debt. But presenting the national debt as

a problem was a means of justifying significant cuts in domestic spending,

which he framed as "redistribution".

source:

http://zfacts.com/p/318.html

Reagan then went on to claim that by reducing income tax rates it would

increase the growth in income tax revenues, and that the principle of

reduced rates leading to increasing revenue would lead to a cycle of income

tax reductions resulting in ever growing income tax collections. In fact

federal tax collections under Reagan grew at the lowest pace of any post

WWII president and his successor George Bush was forced to raise taxes in

order to avert a total budget calamity.

The final irony of this speech is that today is indeed our judgment day

on the negative economic forces that Reagan himself unleashed. Reagan warned

against leaving our children with an "unrepayable" massive debt and a

shattered economy, yet at the time that Reagan took office the United States

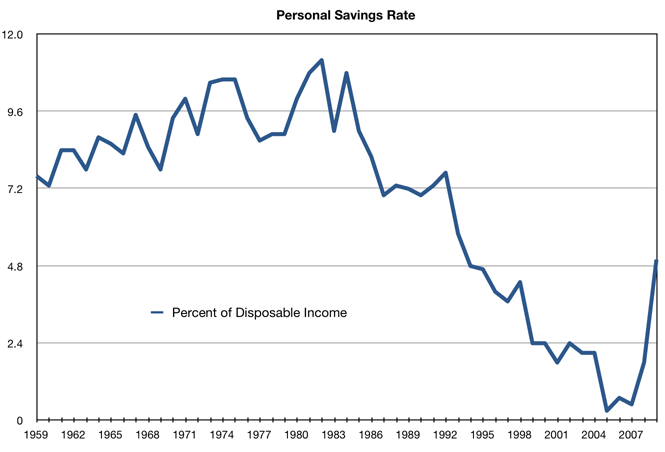

was a nation of savers and the government had barely any debt at all. The

policies instituted by Reagan led to a massive ballooning of the national

debt and turned a nation of savers into a nation of debtors. While the

conditions that Reagan warned against did not even exist when he took

office, Reagan himself set the forces in motion that would bring about the

very conditions that he so direly warned against.

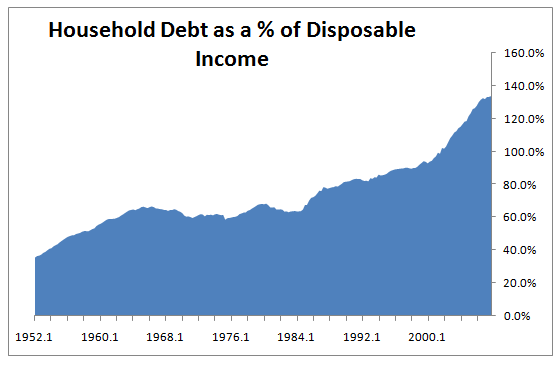

Not only did Reagan's policies lead to massive increases in the federal

debt, but household debt grew as well while personal savings declined.

Of course there were real economic problems in America when Reagan took

office. When Reagan took office the unemployment rate was around 8% and it

peaked at 10.8% about two years into his presidency. Inflation was high in the late 1970s

as were interest rates. Indeed the high interest rates were a significant

factor in the high savings rates and low debt levels.

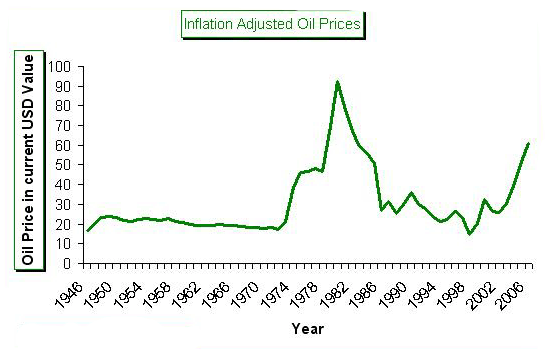

The economic problems, however, were largely driven by two factors: the

Federal Reserve's monetary policy and the energy crises of 1973 and 1979,

which were products of political hostility toward the United States for

American support of Israel and later due to the Iranian Revolution. The

energy crises led to high energy costs and fuel shortages across the

country.

source:

http://www.uranium-stocks.net/uranium-how-high-could-the-price-go%E2%80%A6576/

So the major problems that the American economy faced were high

inflation, caused in large part by the rising energy prices, and high

interest rates, which were pushed higher by the Federal Reserve in order to

try and control inflation. When energy prices began to come down in the

early 1980s due to decreases in demand from lower usage and the adoption

more efficient products as well as massive increases in oil production by

non-OPEC and non-Middle Eastern countries, such as Mexico, Venezuela,

Norway, etc. this reduced inflation and allowed the Fed to reduce interest

rates.

Those two things, the resolution of the energy crises and the lowering of interest rates, were really the

most important factors in the economic recovery of the 1980s. But, of

course, that is not all that was done. The economic crisis of the late 1970s

served as a springboard to enact sweeping changes to the American economy.

Some of these changes, such as deregulation, were set in motion by Democrats

prior to the election of Ronald Reagan, while others, such as tax reforms,

were

most pronounced under the Reagan administration.

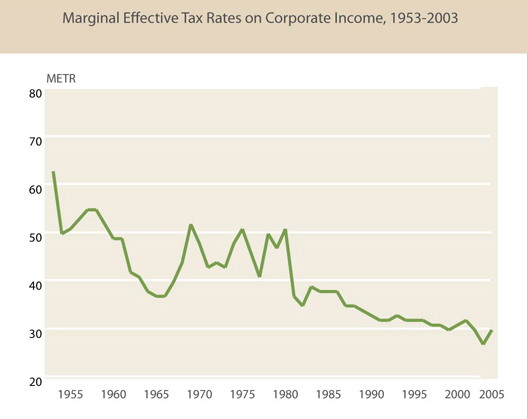

The most obvious changes enacted during the Reagan presidency were the

dramatic reductions in marginal tax rates. Reagan pushed for, and got from

the Democratic congress, significant reductions in capital gains taxes and

the marginal rates on payroll taxes. At the same time, Reagan pushed for,

and got, significant increases in Social Security and Medicare taxes, as

well as a number of other low end taxes. This was advocated by Reagan as a

means of broadening the tax base. Tax reform under Reagan was achieved

through a successive series of bills from 1981 to 1987, which saw the top

federal income tax bracket go from 70% in 1980 down to 28%, while taxes on

the bottom 80% of the country effectively stayed the same or increased

slightly.

While the marginal federal income tax rate was 70% in 1980, there were a

number of loop holes in the tax code, allowing top income recipients to pay

significantly lower than 70% tax on their marginal income, however, the tax

reforms of the Reagan administration still resulted in significantly lower tax obligations on the high

incomes.

In addition to reductions on marginal income tax rates, capital gains

taxes were reduced from an effective maximum rate of 49.875% down to 20%.

The minimum 15% tax rate on capital gains was also eliminated under

Reagan. The tax rates were not just changed, but the entire tax code

surrounding capital gains was changed, shortening the period of time capital

had to be held in order to qualify for lower long-term gains tax rates in

addition to a number of provisions on the holding and realizing of capital

gains.

Corporate income taxes were also reduced under Reagan, to their lowest

levels since World War II at that time (they are now even lower).

source:

http://www.taxpolicycenter.org/briefing-book/key-elements/business/what-is.cfm

Pressure for many of the changes that the Reagan era ushered in had been

building for decades. Indeed Barry Goldwater's campaign for President in

1964 (which highly influenced Reagan) can be seen as the political emergence

of the national movement against FDR's New Deal economy. Reagan made his

name early on politically by campaigning against government programs and

corporate regulation in the 1950s and early 1960s. When legislation for

Medicare was introduced in the early 1960s Reagan toured the country giving

speeches against it and recorded a speech for the American Medical

Association proclaiming that if Medicare is passed, "we will awake to

find that we have socialism. And if you don't do this, and if I don't do it,

one of these days, you and I are going to spend our sunset years telling our

children, and our children's children, what it once was like in America when

men were free."

Other changes were also already underway in the private sector as well.

The way banks were operating was already changing during the 1960s and

1970s, despite a lack of legislative changes, as many processes were

becoming more automated, efficient, and less expensive, leading to changes in

the scale and scope of banking and investment activity. Corporations in

general were getting larger and the percentage of people working for large

corporations was going up. Demands put on the financial sector grew as the

size of corporations and institutional investors grew.

Likewise, changes in the consumer marketplace were already underway by

the time Reagan was elected as well. The rise of large "big-box" discount

department stores began in the 1960s with companies like Wal-Mart, and this

market trend just happened to hit critical mass in the 1980s.

But while fundamental changes in the American economy were already

underway before Reagan ever stepped into office, Reagan further strengthened

corporate interests and helped clear the way for dramatic increases in the

consolidation of capital ownership. Other changes by Reagan and later

conservatives also greatly increased the power and influence of industry

groups and lobbyists in government as well. Furthermore, Reagan had perhaps

the most significant impact on public attitudes toward government and

private industry of any president since Franklin D. Roosevelt. While FDR

played a major role in shaping the public perception of government as an effective

champion of the people against tyrannical moneyed interests, Reagan

successfully portrayed government as a tyrannical force against the moneyed

interests of the people.

When Reagan famously said that, "government is not the solution to

our problem; government is the problem," in his First Inaugural Address

in 1981, he set the political tone for decades, a tone that persists to this

day. Reagan effectively framed government as an enemy of the people and the

wealthy as the saviors of the people, to whom the public was indebted.

There was certainly an undercurrent of racism in the white middle-class

anxiety that Reagan tapped into. There was a perception among middle-class

whites, especially in the South, that the federal government was benefiting

blacks more than whites, that it was effectively taking money from whites

and redistributing it to blacks. During his presidential campaign Reagan

told the story of a woman from Chicago, whom he called a "Welfare Queen". He

claimed that she had multiple aliases and was collecting over $150,000 a

year from the government. It turns out that no such

woman ever existed. Reagan did not specifically say that the woman was

black, but he described her in ways that fit existing black stereotypes, for

example claiming that she was from South Chicago (a predominately black

neighborhood) and drove a Cadillac. Reagan regularly portrayed the recipients

of welfare and food stamp programs as blacks and portrayed welfare programs

as a drain on the average tax payer's wallet. He identified public assistance programs as one of the sources of

the middle-class's economic problems, claiming that the middle-class was

effectively being bled dry by the poor.

This narrative connected with the white-middle class in part because

there had in fact been dramatic improvements in the African-American

economic condition during the 1960s in large part due to federal policies,

though in reality it had more to do with improvements in education for

African-Americans, Civil Rights legislation, and ending overtly

discriminatory policies towards African-Americans. Even though blacks were

still far behind whites economically in America, the economic status of

blacks did improve more rapidly than whites during the 1960s, largely

because they were so far behind to start with.

source:

http://www.pbs.org/fmc/book.htm

The reality is that federal government policies were

helping blacks. The integration of public schools, affirmative action, the

federal fair housing law, etc. all worked to improve the situation of blacks

in America, by combating unfair practices used against blacks. But

improvements in African-American economic conditions were portrayed by

conservatives as a zero sum game, in which black gains came at a cost to

whites, and this played a significant role in convincing many middle-class

whites that it was the poor who were holding them back and that the federal

government was the agent of this attack on the white middle-class.

The reality, however, is that government policy played a

major role in the creation of the white middle-class in the first place. A

number of financial and labor reforms that were put in place by FDR during

the 1930s played a major role in the building of the American middle-class.

The implementation of the minimum wage, the federal backing of labor unions,

federal housing loan programs, the G.I. Bill and other forms of financial

support for going to college, the expansion of the public school curriculum

with a focus on science and math, the subsidizing of cheap food, and the

overall stabilizing of the financial system all helped to build the American

middle-class. Whites also disproportionately benefited from many of these

policies as well, such as the G.I. Bill, and housing loan programs.

source: http://www.musfs.org/faq

source:

http://www.pbs.org/fmc/book.htm

In addition, the rapid expansion of the nation's

infrastructure by the federal government from the 1930s through the 1960s

also had a dramatic impact on the economic development of the country. Again

this impact was greatest for whites, as areas of white population received a

far disproportionate level of development. Indeed white rural America was

the most disproportionate beneficiary of the infrastructural building boom

of the 1930s-1960s, with programs like FDR's

Rural Electrification Program, the

Tennessee Valley Authority, and road development programs transforming

thousands of isolated areas from areas with no electricity, no running

water, and and no paved roads in 1930 into places with electricity, running

water, paved roads, and telephones by 1940. The

interstate highway system commissioned by Dwight Eisenhower in 1956 literally paved the way, along with prior government initiatives, for the

rapid development of the middle-class American suburbs.

source:

http://www.pbs.org/fmc/book.htm

What is most striking about the household income growth shown above

(which shows median income) is that the number of workers per household has

been steadily increasing over the past several decades.

Indeed what little growth there has been in median household income from

the 1980s to present has been a product of the increasing number of workers

per household, not of increasing individual compensation, while growth in

median household income from the 1940s through the 1960s was predominately a

product of increasing individual compensation.

The fact is that the American middle-class was built from the 1940s

through the 1970s, and it has been in decline ever since. America as we know

it is a product of that period. Prior to the Civil War America had an

agricultural economy, in which wealth was relatively evenly distributed

compared to Europe, almost entirely due to the fact that the primary form of

wealth and capital was land, which was easily available, with many ways to

acquire it for free or at a nominal price from the government.

Industrialization began after the Civil War, and with industrialization

income inequality rapidly increased, except for a brief period shortly prior

to and during World War I (due to the growing labor movement and rising

labor prices). After World War I (and the Russian Revolution) the labor

movement was reversed in America, with laws against unionization, and labor prices began falling again.

During this time income inequality increased rapidly until the

administration of FDR. The period from the end of World War II through the

1970s was unique in American history in that it was the only time in

America's industrialized history in which there was prolonged egalitarian

economic growth, in which incomes rose at almost equal rates among all

income classes. Indeed the poor saw the largest gains during this time while

the wealthy saw the lowest.

It is this period that built the broad middle-class that defined modern

American society and laid the foundation for the future American economy. It

was during this time that the American middle-class was larger than it had

ever been, and has ever been since as a percentage of the population.

source:

http://www.faireconomy.org/research/income_charts.html

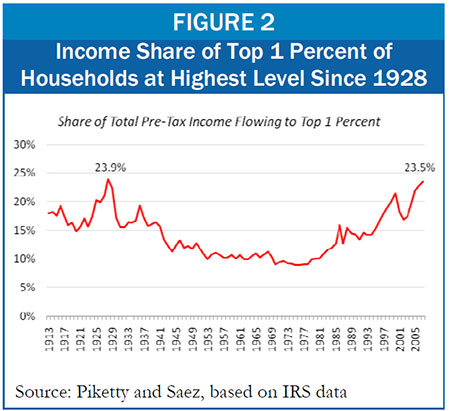

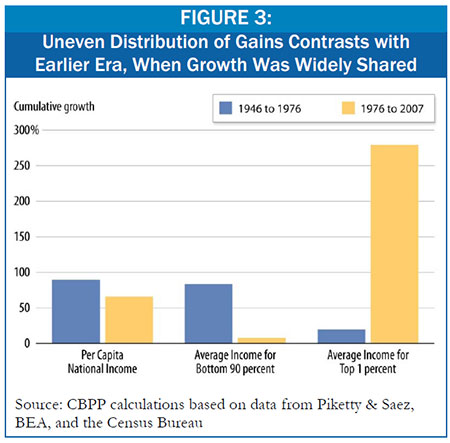

As we can see in the graph above, contrary to the popular claim that

Reagan's economic agenda would be a "rising tide" that would "lift all

boats", the real rising tide that lifted all boats was the period prior to

Reagan, whereas the post-Reagan era has seen gains skewed strongly toward the

wealthy. Because this graph shows household income, not individual income,

the modest increases in the 1st through 4th income brackets are also largely

a product of an increasing number of workers per household, not actual

individual gains.

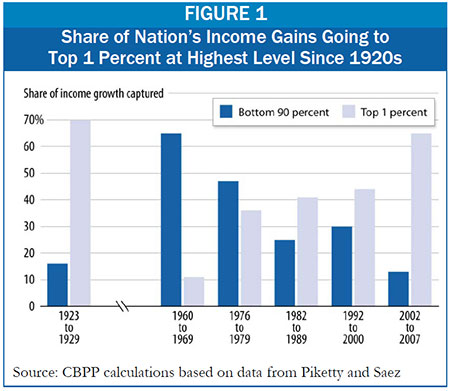

As shown in the data below, the period after World War II and prior to

Reagan was a period when the share of national income going to the broad

base of the population grew the most, while since Reagan income

gains have gone primarily to the top1%.

source:

http://www.cbpp.org/cms/index.cfm?fa=view&id=2908

source:

http://www.cbpp.org/cms/index.cfm?fa=view&id=2908

Figure 3 below shows that not only was income growth much stronger for

the bottom 90% of the people in the period between World War II and Reagan,

but total income growth for the entire nation was also stronger during this

period.

source:

http://www.cbpp.org/cms/index.cfm?fa=view&id=2908

So we can see that the period of most equal income distribution in modern

American history was the period between the end of World War II and the

entrance of Ronald Reagan into office. We can see that the period from the

end

of World War II to the end of the 1970s was a period in which the majority

of the economic gains went to the majority of the people and that in the Reagan

and post-Reagan eras the majority of the economic gains went to the

wealthiest 1% of the population.

That economic disparity in America has grown dramatically since the

"Reagan Revolution" is undisputed, but the question now is, why and how has

it grown?

The period since World War II has seen a relatively consistent upward

trend in Gross Domestic Product, or economic output. GDP growth in the

Reagan and post-Reagan eras is comparable to that from World War II up until

Reagan took office.

http://www.pbs.org/fmc/book.htm

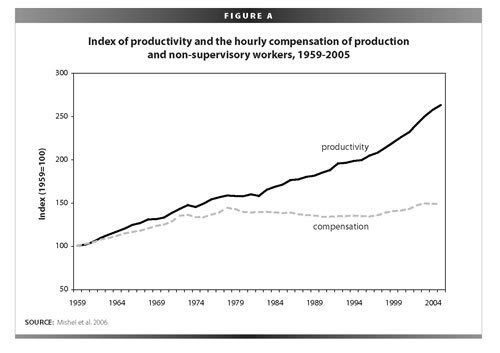

Trends in economic growth have gone unchanged since World War II, so what

accounts for the radical change in the distribution of compensation that is

marked by the Reagan and post-Reagan eras?

source:

http://www.sharedprosperity.org/bp191.html

The graph above is key to understanding the growing income inequality in

America. From the end of World War II through the end of the 1970s the gains

from increases in productivity were broadly shared among all segments of the

work force. Beginning in the late 1970s, however, and continuing on after

that, worker compensation leveled off and the additional gains produced by

increasing productivity went almost entirely to executives

and owners/shareholders.

There are a few different ways to explain this. One is to say that the

economy, driven by market forces, is accurately reflecting the relative

contributions of the different actors in the economy, and that its simply

the case that over the past 30 years all of the growth in productivity is a

product of capital and contributions from management, that essentially 90%

of the work force has made no contributions to the growth in American

productivity over the past 30 years.

That's one possible explanation. A second explanation is that the

compensation going to workers prior to 1980 was too high, i.e. that 90% of

the work force was over paid during the period between World War II and the

1980s, and that what we've seen over the past 30 years has been a market

correction, brought about by the fair and just reforms of the Reagan and

post-Reagan eras.

And yet a third possible explanation is that executives and capital

owners have unfairly been the recipients of all of

the economic gains of the past 30 years, at the expense of the majority of

American workers who helped to produce those gains. Productivity gains produced in part by workers have been

realized by executives and capital owners instead of by the workers

responsible for the gains.

http://www.j-bradford-delong.net/TCEH/2000/TCEH_2.html

The first thing to understand is that worker productivity has steadily

risen in America since World War II, and has risen at roughly the same rate

since 1980 as it did between 1940 and 1970. If anything worker productivity

has actually risen faster over the past 30 years than it did during the 1960s

and 70s.

What our economy is telling us by the way that income has been allocated,

is that the rise in worker productivity over the past 30 years has been solely

a

product of capital and management, i.e. that managers and machines have

effectively produced 100% of the productivity gains of the past 30 years.

The only way that the income distributions of the past 30 year can be called

"fair" and appropriate is if that statement is true, but is that statement

true?

Well, the most obvious measure of the changing workforce is education.

One intuitively expects that a more highly educated work force would be a

more productive workforce. By this measure the contribution of individual

workers to increased worker productivity has continued to rise steadily over

the past 30 years, with the workforce becoming more highly educated with

each passing year.

source:

http://www.pbs.org/fmc/book.htm

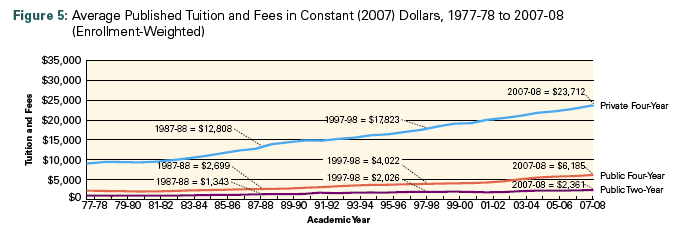

Not only has the workforce become more educated with each passing year,

but the investment of individual workers in their own education has also

increased steadily. Tuition and fees have increased far faster than the rate

of inflation or of average wages over the past 30 years.

source:

http://www.collegeboard.com/prod_downloads/about/news_info/trends/trends_pricing_07.pdf

Although financial assistance has also increased over this same time

period, it has not increased at the same rate as costs, and so even with

increasing financial assistance students are still paying more for their

educations today than ever before.

So while education is more evenly distributed today than any time in American history, income is more unevenly distributed than just about any

time in American history. Not only are American workers more educated today

than ever before, but American workers pay more for their own education

today than ever before as well.

Furthermore, the vast majority of productivity gains deriving from

capital improvements, i.e. the development of better technologies and

systems, are products of the work of ordinary workers. For example the average

income for a computer programmer in the year 2000, the height of the

technology frenzy, was just $57,590, yet much of the productivity gains from

the 1980s on have been the product of broad systematic improvements made by

millions of "average" computer programmers. The same can be

said of all kinds of professions, from scientists to engineers to designers

to technicians to educators, all of whom are making real improvements to

capital, yet extremely few see any of the gains. There are also the

productivity gains that are simply a product of more efficient work

practices, which are products of education and training, and these gains

cross all professions and position levels, from office clerks, carpenters,

and fry cooks on up to managers and executives.

One of the major trends in income inequality that began in the 1980s was

dramatic increases in executive compensation. From the 1980s on, compensation

for the average American worker has barely kept pace with inflation, yet

compensation for executives running the same companies at which worker's pay

has barely kept pace with inflation have seen their compensation levels

increase by orders of magnitude.

source:

http://www.faireconomy.org/research/CEO_Pay_charts.html

So what have been the real driving factors behind these enormous gains in

compensation by top executives, while the vast majority of workers have seen

no gains at all? Are these executive gains justified? Did executives all of

the sudden start creating vastly more value in the 1980s and 90s? Did

Reagan's deregulation, tax cuts for the rich, and other financial reforms

all of the sudden remove the chains of oppression holding top managers down?

As, William J. McDonough, chairman of the New York Federal Reserve Bank,

said in 2002, "I find nothing in economic theory that justifies this

development, I am old enough to have known both the CEOs of 20 years ago and

those of today. I can assure you that we CEOs of today are not 10 times

better than those of 20 years ago."

See:Fed

official decries CEO salaries

There are multiple contributors to this situation, which include the

massive increase in the off-shoring of American production, the decline of labor

unions, and changes in compensation practices by corporations.

As for the off-shoring, the income gains realized by executives from the

off-shoring of American production were essentially one-time gains. These

were effectively windfall profits made by the sale of American production to

foreign countries, i.e. they got rich from selling America out. Notice that

I'm not using the word jobs here, I'm using the word production, because we

aren't just talking about jobs. Even if these executives laid-off the same

number of workers and replaced them with robots and automated systems here

in America that would still be better than off-shoring. Yes, given the

current economic system it would still have led to growing income

inequality, but by off-shoring American production to foreign countries

these executives have not only eliminated certain jobs (arguably others are

also created) but they have also reduced American control over production of

the goods and services used by Americans, and not only have we lost some

degree of control, but we have also lost capital and not only have we lost

capital, but we have also lost the engine for further capital

development.

Growth in executive compensation due to off-shoring is essentially the

product of the elimination of domestic workers and replicating them with

foreign workers at a lower cost, with a portion of the difference being

awarded to executives. With American unions in decline, the ability of

workers to fight such moves or to bargain for better terms of release has

been diminished. Even if one argues that off-shoring creates new economic

opportunities in America, this still doesn't justify the compensation going

to executives for the practice, because those executives aren't the ones

creating the new jobs, their compensation bonuses come from the elimination

of existing ones, not from the creation of new ones.

But off-shoring and the decline of unions don't account for everything,

there are other major factors. Over the past 30 years executive compensation

has changed dramatically, not just in the amounts of the compensation, but

also the forms of it. During the 1980s and 1990s executive salaries increased

dramatically relative to average workers, but other forms of compensation

increased even more, such as awards of stock, severance packages, cash

bonuses, interest

free loans, use of corporate property, and short-term incentive bonuses.

Unlike compensation for other employees, executive compensation is often

governed by a board of directors, and that board of directors is typically

elected or appointed by share holders. But who are the shareholders?

Well, since the end of World War II the portion of US stocks held by

individual investors has been in decline, crossing the 50% mark in the

1980s. While the majority of stock was held by individuals from the end of

World War II until the 1980s, today individuals directly hold only about 30%

of US stock, the rest is held by institutional investors.

So what does this have to do with anything? Institutional investors have

different interests than individual investors and different perspectives.

Over the past three decades boards of directors have become more homogenous

as well, with more of the same people sitting on boards of different companies.

Institutional investors are now the primary electors and appointers of

boards of directors, and these investors are themselves wealthy. They are

more likely to support high compensation packages for executives and less

likely to take an interest in compensation for the average worker.

But there is even more to it than just that as well.

Executive compensation is also a form of protection against takeovers. In

effect, executives are paid in part simply not to destroy the company, i.e.

they are paid not to undermine the interests of the shareholders by

engineering undervalued corporate takeovers and things of that nature. In

addition, executives have significant control over share price by the manner

in which they report information. So executives are paid highly in part in

order to provide a disincentive to underreport information leading to lower

stock prices, which makes takeovers easier and less costly.

Now, in the 1980s and 1990s continuing deregulation of industries as well

as other factors made the environment ripe for takeovers. As a result the institutional shareholders appointed

executive compensation boards who worked in their

interest to highly compensate executives as a means of defense against

hostile and undervalued takeovers. As institutional shareholders became more

powerful, it led to an arms race, in which the threat of takeovers grew and

the defense against them grew as well.

Giving executives extremely high pay and golden parachutes (extremely

rich termination packages) was seen as form of insurance against hostile and

undervalued takeovers. The decline of unions also paved the way in this

regard as well, because union contracts also form as a protection against

hostile takeovers, but as unions declined this opened the door for more

takeovers, leading to the further pumping up of executive compensation.

So in this sense, executive compensation has very little to do with

reward for performance, it is simply a form of insurance, the price of which

got ever higher with deregulation and deunionization. But again that still

isn't the whole story, there was another aspect to this as well , which was

the ever decreasing interest rate.

With the Federal Reserve continuously lowering the interest rates this

also contributed to the building of leverage needed to engage in corporate

buyouts and consolidation. So what happened over the past three decades was

a snowball effect, in which concentration of capital led to the further

concentration of capital, and as an insurance against being undermined by

the executives in charge of all of this capital, the institutional

shareholders grossly overpaid them as a means of buying their loyalty.

There were side effects of this executive compensation as well though,

most of which the institutional investors were happy with. High executive

compensation and short-term bonuses, which have grown tremendously over the

past three decades, are engineered as a means to prevent executives from

undermining the company by causing the share price to be undervalued, making

the company ripe for a takeover. The converse is true as well, however, that this

type of compensation leads to inflation of stock prices due to overly

optimistic

reporting, as we should have all learned by the events of the past 10 years

since the initial dot.com bust of 2000 and the several busts and scandals

that have emerged since. But the investors didn't mind inflated stock

prices, especially since investment institutions typically work on a commission basis

and thus get paid more the higher the prices go.

In addition to all of this there was yet one more factor that I believe

contributed to high executive compensation, and that was the rising incomes

of "superstars" in general. The rise of superstars really began in the late

19th century with the rise of national newspapers and increasing literacy

rates. Each technological advance that made it possible to copy and

spread the performance of an individual to larger and larger audiences

without any additional work on the part of the performer increased the power

and wealth of superstars. Radio, movies and television have all of course

played important roles in the growth of superstars, but in the 1980s and

1990s superstardom was taken to new levels.

In the 80s and 90s the incomes of singers, musicians, and athletes

skyrocketed due increasing exposure, increasing power of the media channels

carrying their performances (caused by media company consolidation), increasing numbers of Americans consuming

programmed media, expansions of the roll of superstars into a wider range of

outlets, and importantly the growth of portable and home based forms of

media consumption, such as audio and video tapes, then CDs and DVDs.

And so a vast array of technological advances and corporate collusion led

to ever higher paydays for the superstar products of the entertainment

industry, all made possible by intellectual property right laws which

entertainment companies have successfully lobbied to strengthen over the

years.

As compensation for superstar entertainers grew, it was only natural for

the incomes of other types of so-called top performers to try to keep pace.

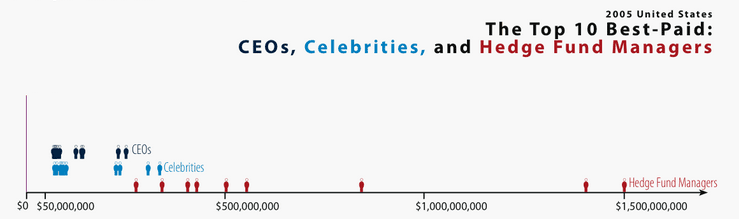

The result is that by the 1990s three major types of super income

receivers had a emerged: Corporate executives, entertainment superstars, and

investors. Of professional investors, hedge fund managers have stood out over

the past decade as receiving especially high incomes. (Hedge

funds are effectively unregulated private investment funds).

source:

http://www.visualizingeconomics.com/

As was the case in 2005, the income of celebrity superstars generally

even outpaced that of corporate executives, but the income of hedge fund

managers grossly overshadowed even that of celebrities, with the top hedge

fund manager in 2005 receiving an income of 1.5 billion dollars for the

year.

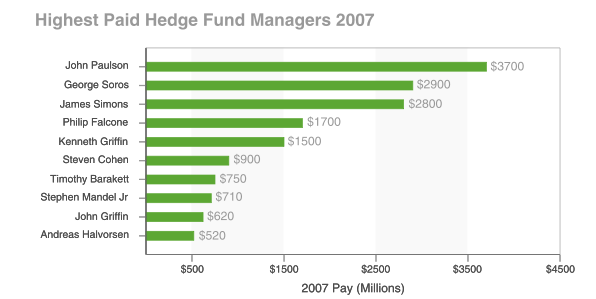

Even that income was greatly eclipsed in 2007, however, when the top

hedge fund manager had an income of 3.7 billion dollars and five hedge fund

managers had incomes of over a billions dollars each for the year.

Essentially all of this income was taxed at the lower capital gains tax rate

of 15% as well by the way.

source:

http://www.visualizingeconomics.com/

What each of these types of income receivers (corporate executives,

celebrities, and investors) has in common is that their incomes are products

of collective systems. Celebrities are a bit different than executives and

investors, though in actuality the incomes of the top celebrities such as

Steven Spielberg and Oprah Winfrey are heavily reliant on control of capital

as well. The incomes of celebrities, aside from their investments, are

almost entirely a product of the technological ability to multiply an

individual's work so that a single unit of labor is amplified into millions

or now even billions of units of labor, with no extra effort on the part of

the "laborer". While technology provides the means to do this, it is

ultimately intellectual property right laws that allows celebrities (or

anyone else using such labor amplification technologies) to become wealthy

from their efforts.

Celebrities benefit from the fact that via technology they can put in one

day's work, say eight hours of work in a recording studio or movie set, and

have that work recorded and effectively turned into billions of hours of

work, and that there is a legal system in place which effectively turns that

recorded work into a form of capital, to which they (or their

producers/managers, etc.) retain rights.

Under this set of circumstances what happens is that enormous levels of

compensation are awarded to marginally "better" (in theory) performers. In

other words, those that come in first place get hundreds or thousands of times

greater rewards than those that come in second place, even though second

place may only be fractionally "less good" than first place. Thought about

in terms of a race, its like a situation where a first place runner runs a

mile in 4 minutes and is awarded $10,000 and a second place runner runs the

mile in 4 minutes and 5 seconds and is awarded $1,000, third place takes in

$500, and the fourth place runner who ran the mile in 4 minutes and 45

seconds gets nothing.

The first place runner receives 10 times more compensation than the

second place runner, but the first place runner isn't really 10 times better

than the second place runner. Likewise, the fourth place runner is only a

little slower than the first place runner, but gets no compensation at all.

This is similar to how celebrity incomes work, where the entertainment

market is dominated by a relatively small number of performers who are

really only marginally "better" than other performers (better in this sense

being judged by their ability to garner incomes) yet they receive massive

rewards for their marginally better contributions due to the fact that

performance amplification (i.e. recording and transmitting technologies)

creates a marketplace in which a small number of performers supply the

demands of exponentially larger numbers of consumers.

So celebrities are a little different than other types of high income

receivers, but their incomes are still rooted in control of capital and

their incomes are also still products of redistribution from social systems,

in which their single units of labor are transformed into many units of

labor by technology which can only be supported by the actual labor of thousands,

millions, or billions of other workers. If not for the wealth created by

other workers, celebrities would have nothing, as the products of their own

individual labor by itself is meager.

Executives are the most obvious beneficiaries of collective systems,

however, as

they sit directly at the tops of collective pyramids. A corporation is a

collection of individuals working together to create value. Executives

typically create little or no value themselves directly. The incomes of

executives have to come from the collective pool of wealth created by the

workers in the corporation who produce tangible assets. All of the income of

executives is effectively a product of redistribution from the producers of

tangible assets to the executives.

Value that is paid to executives is value that was created by other

workers in the corporation, but was not paid to them, and was instead

redistributed to the executives, and as such, each dollar paid to executives

represents in real dollars a loss of income to the workers who produced it.

This isn't to say that executives are worthless and deserve no income, they

do perform services that, in theory, when done correctly, benefit the other

workers at the corporation, and thus of course they deserve some

compensation.

Executive compensation has risen so dramatically over the past three

decades not because executives started producing more value, however, but because

control of capital has become more important and more powerful, and as the

heads of corporations executives are the ones who control the capital. Their

incomes are a product of capital control, not of their contribution to value

creation. In other words, their incomes are a product of position, not

production.

As for investors and investment managers, all of their income effectively

comes from capital gains. All capital gains are a product of work done by

other people. Without employees working there would be no capital gains.

Large investors are the ultimate beneficiaries of collective systems and

socially created value. Celebrities benefit from the technological ability

to turn their form of work into a type of capital that allows a relatively

small amount of work to be exponentially expanded into a means of receiving

value from millions of people, but at base their own work is the root of

their wealth.

Executives benefit from the value collectively created by workers at the

corporations that they sit atop.

But large investors benefit from value created by millions or billions of

workers around the word. All forms of investment income, i.e. rents,

interest, dividends, and gains from the sale of capital, are only made

possible by value created through work. If people don't work then value is

not created and rents don't go up, capital is useless, and there is no value

from which to pay dividends, etc.

In this sense investment income: rents, interest, dividends, etc., are

all forms of taxes on labor. The income of the investor is not generated by

the investor, the income of the investor is generated by other people, and

then transferred to the investor via the legal system. If other people don't

work then the investor won't have an income.

This is the difference between value created by an individual vs. value

transferred to an individual. For example if a farmer has a family farm that

produces 100 eggs, 10 gallons of milk, 20 lbs of meat, and 50 lbs of

vegetable a day, then that family is producing that amount of value each day

regardless of anything else. That is clearly value created by them and no

one else. If everyone else in the world decided to stop working and the

economy totally crashed and no one bought anything from anyone else, that

family would still be producing that value and would still benefit from it.

This isn't the case with investment income however. With investment

income, none of the value is produced by the investor, and all of the income

is dependent upon collective value creation and social systems.

If an investor invests $1,000 in a business on a condition of a 10%

annual dividend (on a condition to get paid $100 a year), and then the

workers decide to all just quit, then no value will be created, the company

will fail and the investor will lose his investment and will get no income

from it.

Investors provide a service by effectively sharing capital, but incomes

from investments are dependent upon other people using that capital in ways

that generate new value, some portion of which is then taken from the

creator of the new value and given to the investor as compensation for the

service provided by investing.

There is nothing fundamentally wrong with capital gains/investment

income, a.k.a. unearned income, the issue however comes in its distribution,

and recognizing that

investment income is not representative of value that is created by the

recipient, rather it represents value that was created by other people.

Obviously, however, people, especially those with high incomes, receive

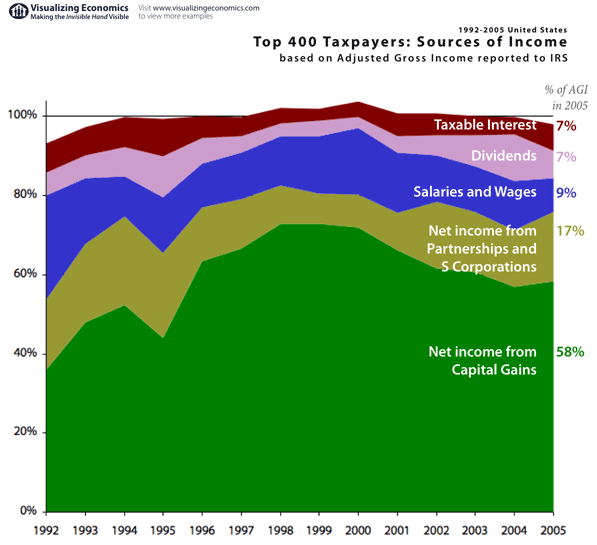

income from multiple sources. Celebrities don't just have income from their

own performances, executives don't just have income from the compensation

they get from their position. The fact is that almost all of the income for

the wealthiest Americans comes from investment income.

source:

http://www.visualizingeconomics.com/

The vast majority of the income of the wealthiest individuals comes from

investment income, because this is the only way that such high incomes can

be generated. Again, high incomes are generated through investments not due

to the contributions of the individual investor, but because investment

income is a product of collective wealth generation, whereby value created

by millions of people is transferred to single individuals.

Consider the $3.7 billion income of John Paulson the hedge-fund manager

in 2007. In order to argue that John Paulson actually "earned" that income,

one would have to argue that John Paulson himself created $3.7 billion worth

of value for the economy, for which he was compensated. If this were true,

it would mean that John Paulson created as much value as 73,656 average

working Americans with incomes of $50,233 in 2007. This would be to say that

John Paulson created more value than most moderate sized American cities in

2007. Is that reasonable? Of course not, because John Paulson didn't cerate

$3.7 billion worth of value, he extracted $3.7 billion worth of value

without having created it and without even having created anything close to

it.

But what about entrepreneurs, like Bill Gates, Michael Dell, Sam Walton,

etc. these people really have made major contributions and created real

value over the past 30 years. Yes, this is true, but again the level of

their compensation still far exceeds the level of their individual

contributions. None of these people personally created billions of dollar

worth of value. They all played important roles in the development of

systems that were used by other people to create billions of dollars worth of

value, but they themselves did not create that value, yet they as

individuals received billions of dollars worth of compensation.

It's not to say that entrepreneurs like this shouldn't be highly

compensated, but it is to understand that the levels of compensation

received by entrepreneurs in the 1980s and 1990s were not a product of their

own making, it was a product of their ownership of rights to value created

by other people in corporations that they founded.

For example Michael Dell began building computers in his own dorm room in

college, where he got his start in the industry. Those computers were

computers that he personally created and income from selling them represents

value directly created by him. He went on to ultimately become the CEO of his

own company, Dell Inc., which sold high quality low cost computers that were

manufactured in Malaysia and China. Michael Dell's wealth comes from the

sale of millions of computer systems and components, none of which were made

by him. His wealth was made possible by the fact that he was able to have

computers built in Malaysia and China by underpaid workers. Without

those Malaysian and Chinese workers building the cheap computers there would

have been no Michael Dell, he would never have become super wealthy.

Again its not to say that Michael Dell didn't deserve high compensation

for his contributions to developing a supply system for affordable American

computers, but the level of his compensation from Dell Inc. was

unquestionably a product of the value created by thousands of other workers

around the world. Without those workers building the computers Michael Dell

could never have become wealthy. The level of his wealth was a function of

the effective tax levied on the value created by those workers. His ability

to levy that tax on the value creation of others is a function of capital

ownership laws in both the stock directly owned by him and in his

compensation as a CEO, determined by a board of directors, put in place by

stock holders (including himself).

The point is that everything comes back to capital ownership and control.

The very high incomes in America and other capitalist countries are all

products of capital ownership. Very high incomes are not the product of

individuals working harder to produce more value than others, they are the

product of ownership rights to capital which effectively draw income from

the value produced by thousands or millions of workers in America and around

the world. So all of the highest incomes in America (and generally around

the world) are products of massive systems of collective production, in

which significant portions of collectively produced value is funneled to a

relatively small number of people. Millions, and ultimately billions, of

people creating value, significant percentages of which are funneled to a

few thousand people is what makes the wealth of the world's richest people

possible.

When we look at a breakdown of income type by income group, its clear

that the wealthiest Americans receive a significantly higher portion of

their income from capital than the vast majority of other Americans. As a

side note, "transfer income" refers to income from government programs, such

as Social Security, unemployment insurance, income assistant, etc. While

transfer income obviously makes up a larger portion of income for low income

groups, in fact the total amount of transfer income received by all income

groups is about the same, with the top 1% actually receiving among the

highest amount of transfer income per person.

When we look at the distribution of income vs. tax receipts by type,

however, we see that despite the fact that capital income is by far the

primary form of income for the wealthiest Americans, the tax burden falls

disproportionately on income from labor. As of 2004 the form of income that

is most heavily concentrated among the wealthy was taxed the least, while

the form of income that was dominant among working class Americans is taxed

the most. This has actually been the case ever since the so-called Reagan

Revolution. The extent to which capital income was taxed in relation to

income from labor fluctuated in America throughout the 20th century, but for

most of the 20th century it was agreed that it was "unfair" to tax

"unearned" income, i.e. income from capital, at rates significantly lower

than earned income, or income from labor. The tax burden on capital was

significantly reduced during Reagan's presidency and has been reduced

further since his presidency in following with the trends established during

the Reagan Revolution.

Despite rapid growth in the number of Americans owning stock over the

past 30 years, the reality is that there is continued and growing disparity

in capital ownership and investment income. Yes, more Americans

own at least some form of stock today than ever before, but this hasn't

translated into more equal distribution of capital ownership overall or of

investment income. In fact, the wealthiest Americans receive a larger share

of investment income today than any time in American history, aside from

just prior to the market crash of 1929.

Share of capital income received by top 1% and bottom 80%, 1979-2003

source:

http://sociology.ucsc.edu/whorulesamerica/power/wealth.html

There are multiple reasons for this. Yes, more people own some stock

today than ever before, but the amount of stock (including mutual funds)

owned by most American stock holders is very small, less than $10,000, while

the wealthiest Americans own billions of dollars worth of stocks each. In

addition, the majority of stocks owned by Americans in the bottom 80% of the

income population are owned inside of retirement plans like 401(k)s and

IRAs. What many Americans don't realize is that income from these retirement

plans is taxed as though it were wage income, it is not taxed at the lower

capital gains tax rates. The idea that around half of Americans "own stocks"

is used to support the low capital gains tax rates, when in fact the only

people paying those rates are individuals who generate income from

investment outside of retirement plans, which is almost exclusively wealthy

Americans.

So while about half of Americans own stocks, the majority of those

Americans are taxed at the higher wage rates on their investment income

because most American's investment income comes only from their retirement

plans. Likewise, with the growth of individual retirement accounts since the

1980s, it means that more of the capital that individuals do own is locked up

in retirement accounts, and is thus not a source of income for most Americans

until after age 65. The only people with meaningful investment income prior

to retirement are wealthy Americans.

source:

http://www.pbs.org/fmc/book.htm

As can be seen in the graph below, despite a significant increase in the

number of people owning at least some stock during the 1990s, there was

really no impact on the distribution of stock wealth. Yes, more people

bought into the stock market in the 1990s, but the share of stock wealth

owned by the wealthiest Americans nevertheless stayed the same or increased

over this period.

Furthermore, the so-called democratization of stock ownership has not

lead to democratization of capital control, because despite the fact that

more Americans own stocks today than ever before, the vast majority of that

stock ownership is through mutual funds which are controlled by

institutional investors, who in the end gain greater control and

influence via the use of other people's money. More Americans today own some

kind of investment, but far fewer stocks are owned directly by individuals,

and average individuals who do directly own stocks own such small amount

that their voting rights are meaningless, so while more Americans have

investments in the stock markets today than in the past, Americans as a

whole have actually lost ownership influence among publicly traded

corporations.

And the situation is even worse when it comes to private corporations and

small businesses. The percentage of Americans owning a meaningful business

today is lower than ever before. Yes, the number of small businesses has

gone up significantly in America over the past two decades, but this growth

in business entities is misleading. There are two primary drivers of this

growth, what I call "micro-businesses" and also a growth in the creation of

separate business entities for legal and tax purposes, which are actually

owned by parent corporations.

What I call micro-businesses are side businesses that people establish

for minor part time work, but these businesses are not primary means of

income, and they often report no income at all for years, with many people

running micro-businesses with yearly incomes of less than $5,000 a year.

These are side businesses for things like computer consulting, selling

self-published books, selling arts and crafts, etc. There is typically

little or no meaningful capital associated with these businesses. The

reality is that more people work for large corporations today than ever

before, and during the past 30 years there has been a significant decline in

real small business ownership. By a "real" small business I mean a business

that actually supplies an individual or family with their primary income.

Small businesses like individually owned restaurants, hardware stores,

pharmacies, grocery stores, clothing stores, mechanic shops, fabrication

facilities, furniture manufacturing shops, repair shops, etc., have all diminished

significantly over the past 30 years as capital concentration has lead to

the dominance of large corporations in these and other fields. So, even with

growth in the percentage of Americans owning stock, one has to consider that

the percentage of Americans owning their own privately controlled capital

has gone down. In other words, while the percentage of Americans owning

small fractions of public corporations has gone up, the percentage of

Americans owning their own meaningful capital has gone down significantly.

As a society, Americans have less control over capital today than ever

before. Average Americans own and control less of their own capital today

than ever, and what capital is owned by average Americans is largely owned

through financial institutions who practice the actual control over the

capital.

Conclusion and Summary

It is widely acknowledged by economists and political scientists that the

economic policies of the United States over the past 30 years have been

highly influenced by the economic agenda of the Reagan administration, both

by Reagan himself and by the multitude of politicians and scholars and

appointees that came to power during his presidency. Throughout Reagan's

life and political career he railed against government programs, economic

regulations, and taxation. This began with his political speeches in the

1950s and continued throughout his career. Yet when Reagan became president

in 1980 he talked about "restoring America", but restoring America to what?

Restoring America to how it was prior to World War II? That isn't what he

meant and it isn't what conservatives meant when they talked about restoring

America. Reagan had railed against the policies of the 1940s and 1950s back

in the 1950s, and he continued to do so in the 1960s, yet the "Golden Age"

of the American economy was the 1940s-1960s, with the large middle-class

that was built through the policies that Reagan railed against.

In the 1980s Reagan talked about restoring America, yet his policies were

designed to do the exact opposite economically, they were designed to undo

the America that middle-class Americans had come to think of as the "good

ole days" to which America would be restored. The America of the 1940s and

50s was an America of a strong central government, with a highly regulated

economy, built through the extensive use of federal programs and massive

federal subsidization of the white middle-class. And that is what it was

really all about. "Restoring America" always meant "restoring white

dominance", yet it could never really be admitted that the white dominance

of the 1940s-1960s was itself a product of government programs.

What happened in the 1960s and 1970s was that discriminatory practices by

the federal government and state governments were challenged and the

benefits of government programs began increasingly going to blacks and

minorities in the way that they had only gone to whites previously. When

this happened a new narrative emerged among conservatives, a narrative that

was echoed by Reagan, and which became a fundamental national belief when

Reagan came to power in 1980. This false narrative was that the white-middle

class had established itself all on its own, not with the help of the

federal government, but indeed despite the obstacles put in its way by the

federal government.

You see, once minorities began receiving many of the same benefits from

the government what whites had enjoyed for decades, one could not simply say

that blacks shouldn't be able to get the same benefits as whites, and one

couldn't acknowledge that whites had gotten where they were with the help of

those same benefits. For those that opposed minority access to government

benefits the convenient narrative was that whites had never needed such

benefits in the first place and therefore no one should have them now.

This was a core aspect of how the American federal government became the

enemy of post-World War II conservative America. The government was seen as

good by the vast majority of whites in the 1940s and 1950s, when the

government was almost exclusively helping middle-class whites. When

government policies began adopting measures of fairness so as to give the

same benefits to minorities that it gave to whites, then the white

middle-class was easily turned against such policies.

But this merely opened the door for the adoption of broader "free-market"

policies and ideology. Many of the so-called "free-market" policies of the

Reagan era weren't readily supported by the white middle-class, but the fear

stirred up by conservatives that government involvement in any shape or form

might lead the incomes of whites being taxed away and given to undeserving

minorities, or that government programs would in one way or another help

blacks at the expense of whites, was enough to push many middle-class whites

to support economic agendas that they otherwise would not have.

While Reagan and conservatives railed against government debt and federal

spending, the policies of Reagan and the Republican party as a whole brought

about unprecedented levels of deficit spending that had not been seen since

World War II. Reagan came in to office lamenting what he called an

unsustainable national debt, yet by the time he left office the debt had

almost doubled as a percentage of GDP (and had far more than doubled in raw

dollar terms). Not only had the debt of the federal government been pushed

to its highest point in decades by Reagan's policies, but personal debt grew

significantly as well.

Conservative defense of growing income inequality was simple, the basic

claim was that voiced by Milton Friedman, which was that the standard of

living was improving and that was all that was important.

In the particular problem of inequality, what is true, what is unquestionably

true, is that there's been a widening difference in wages earned. You have had

the skilled wages go up relative to the unskilled wages. However, there has been

no comparable widening in the levels of consumption. If instead of looking at

income, you look at levels of consumption, if anything that's become more equal.

The fraction of families that have a dishwasher, that have a sewing machine,

that have a television set. In respect to consumption, it's very hard to avoid

the view that people have been getting more equal rather than more unequal.

Milton Friedman, 2000:

http://www.pbs.org/fmc/interviews/friedman.htm

The fact that an economist like Friedman could acknowledge that there was a

disparity between consumption levels and income levels and not acknowledge

the obvious implications in terms of debt is astounding, and yet it was also

quite typical. Free-market economists since the time of Reagan flat out

failed to address the fact that economic stability and the ability of the

middle-class to support the economy is inherently tied to income inequality.

That as income inequality increases the stability of the economy decreases

and the ability of the middle-class to support the economy decreases.

Friedman always failed to acknowledge the fact that the growth seen in the

American economy from the 1980s through the end of the century was propped

up by unsustainable levels of personal debt, deficit spending, an ever

increasing number of workers per household, and one time gains from the

exporting of American production to foreign countries.

And this is the issue that the majority of people continue to fail to

understand today. The American economy of the past 30 years has always been

unsustainable. Conservatives today talk about the "economic miracle" that

occurred under Reagan, but the fact is that economic growth was modest under

Reagan, and what economic growth did take place was largely a product of

borrowing. The economy of the past 30 years has been built fundamentally on

debt and other unsustainable trends, such as lack of investment in

infrastructure and constant reductions of interest rates to fuel the debt

dependent economy.

But at a certain point, when interest rates get too low, borrowing itself

begins to greatly distort the economy, as we saw in spectacular fashion with

the housing bubble of the 2003-2007. The ability to borrow cheaply leads

economic actors into making decisions that they would not otherwise make.

And this played a significant role in the ballooning of executive

compensation as well, as the ability to borrow cheaply, combined with

deregulation, brought about an environment of excessive corporate takeovers

and mergers, leading to the rise of "defensive" compensation practices for

corporate executives, who were given compensation packages completely out of

line with their contributions in part as a defense against hostile

takeovers.

And while the trend toward concentration of capital ownership and control

was already underway prior to Reagan, the economic policies of Reaganomics

opened the flood gates instead of strengthening the dam, leading to an even

more dramatic rise in capital concentration over the past 30 years than

would have otherwise been the case. The concentration of capital ownership

by institutional investors added further fuel to the income disparity fire,

with institutional investors acting in ways that individual middle-class

investors previously had not. This helped pave the way for the massive

off-shoring of American industry in the 1990s, during the time of cheap

fuel, cheap borrowing, and institutional investors who were cozy and

comfortable with executives but not workers, who pushed executives to take

actions that would lead to greater market volatility and short-term gains,

both of which were beneficial to "investment" institutions, while they are

not particularly healthy for long-term economic stability and growth.

The result was that many people got rich quick during the 1980s and 1990s,

while their very actions were leading to the overall demise of the American

economy. Indeed the system of incentives that emerged from the Reaganomic

agenda is one that has driven the country into a downward economic spiral

as those driving the economy into the ground benefit from its destruction.

One of the biggest economic ironies of the past 30 years has

been the belief among conservatives, famously voiced by Reagan, that

"government is the problem", and the claim that government spending

inhibits economic growth, when in fact two of the technologies that

contributed the most to real economic growth in America over the past 30

years were developed by the government: the internet and satellite

technologies.

The internet is the type of technology that is very unlikely

for the private sector to ever develop, because when the internet was being

developed there was no immediate commercial intention for it. Furthermore,

it's something that took decades to develop and we know that during this time

there was no similar private network being developed, and if some company

had developed similar technology they would have made it proprietary and

intentionally not open in the way that the internet is today. It is the

openness of the internet that has made its economic impact so huge.

One of the other major technologies upon which real economic

growth was produced over the past 30 years is satellite technology,

primarily satellite communications. Telecommunications as we know it today

would not exist without the major pioneering of satellite communications

technologies by the federal government and the N.A.S.A. space program in

general. Today everything from G.P.S. to telecommunications to weather

forecasting to the entertainment industry owes a debt to decades of

government research and funding for the development of the technologies that

make modern information transmission possible. The internet and satellites

are quite arguably the most important technologies of the past 30 years,

upon which huge segments of our modern economy are based, and these are both

technologies that were fundamentally developed by the American federal

government, with the next closest rival being the government of the Soviet

Union, not free enterprise.

It was only after these technologies were developed to a

working and proven level by government programs they were then adopted,

exploited and expanded upon by private industry.

While many economists and pundits talk about how long it

will take to recover from the current recession and for the American economy

to return to its "normal operation" of the past 30 years, they fail to

recognize that the economy hasn't been operating "normally" for the past 30

years in the first place. The reality is that the demise of the America

economy began some 30 years ago. The seeming decent functioning of the

economy these past 30 years has been an illusion propped up by public and

private debt, and basically by riding on the solid base that was built in

this country during the 1940s-1960s. The solid economic base that was built

during that time, both in terms of the middle-class itself and in terms of

infrastructure and institutions was so strong and so well built that it was

able to carry the country for several decades even as it was being weakened.

The policies of the Reaganomic agenda reduced investment in the nation's

infrastructure, reduced investment in education, reduced investment in

long-term research and development, and instead squandered resources on

grossly over-funded military spending and on privatization schemes that

resulted not in the shrinking of the size of government nor in the

improvement of government services, but rather in the development of a

private sector with a profit motive to continuously get its hands on more

and more tax payer money.

Turning the government into a contract broker that funnels

taxpayer money to private for-profit companies is not a way to reduce

government spending, indeed it inevitably insured increased government

spending, as the privatization schemes of the past 30 years have proven.

There is a reason that government spending never went down with the private

outsourcing of government work, because by getting private companies so

heavily involved in the running of the government it inevitably did not lead

to more efficient and effective government, it led to a government

controlled by the private sector, which the private sector has become able

to use as a tool to increase profits. The private sector works well when it

is truly fully private, and the public sector works best when it is truly

fully public. It's when you give the private sector large scale access to

public funds that corruption and complications inevitably take place,

yielding results far worse than what either the private or public sectors

would produce independently.

The fact of the matter is that the policies of Ronald Reagan

and his ideological supporters in office have directly led to the ballooning

of public and private debt in America, to increased income inequality,

deterioration of the nation's infrastructure, and the weakening of the

American middle-class. The economy of Reagan was always an illusion. The

real economic growth that has taken place since 1980, and there definitely

was some real economic growth, owed much of its success to the solid

economic and technological base that had been built in this country in large

part by the federal programs of the 1940s-1960s.

Not only has the economy of these past 30 years been largely

propped up by debt and by a lack of engaging in the spending necessary to

truly sustain and grow the country and the economy long-term, but the

undoing of many of the tools for the promotion of economic fairness that had

been in place from the 1940s through the 1970s also means that a minority of

the population has benefited immensely at the expense of the working class.

Not only has a small minority of super-wealthy Americans benefited

disproportionately from the value produced by the American economy as a

whole, but this disparity in income and wealth growth has itself undermined

the economy and exacerbated American economic instability.

The incomes of the wealthiest Americans these past 30 years

has been flat-out unearned and undeserved. It is the largest case of

redistribution of wealth in this nation's history with the exception of the