|

Biology and Economics: Using Science to Understand Human

Choice

By

- May 12, 2005

- May 12, 2005

The economics that is widely accepted and taught in the

Western world today is generally known as Neoclassical economics. Neoclassical economics

can be considered to cover a relatively wide range of economic thought ranging from the pure

“free-market” economics of those like Milton Friedman to the Keynesian economics

of John Keynes.

What virtually all of the Neoclassical schools of thought share, is a

view of human beings as rational informed value judging individuals, whose

behaviors can be modeled by mathematical formulas.

In the latter part of the 20th century, American

Economist Paul Samuelson, one of America’s leading economics textbook authors,

and arguably the most influential economist of the post-war era in the West,

furthered the view of economics as a type of mathematical science. For Samuelson

and other Neoclassical economists, economics is a subject to be studied with

graphs and formulas.

While math has always played some role in the study of

economies, Samuelson and other Neoclassical economists greatly elevated the role

of math, turning economics predominately into a study of numbers.

Interestingly, however, Neoclassical economists continue to

define economics along traditional lines, as the study of human choice in

relation to resources:

Economics: The study of how people use their scarce

resources to satisfy their unlimited wants. [1]

- Economics 6e, A Contemporary Introduction

Actually, though, Neoclassical economics leaves out all study of

human beings. Neoclassical economics, i.e. the school of economics taught in

virtually every school from Tokyo to San Francisco to New York to

London to Paris to Berlin and now into Prague and even Moscow, completely leaves

the study of human beings out of the study of human choice.

Marketers, however, do study human beings, and do study how

and why human beings make choices.

The not so secret "dirty little secret", however, is that

there is somewhat of an implicit agreement between economists and marketers not

to share information that would invalidate standard economic assumptions. Even so, students in business school or

marketing go to economics classes and learn about the laws of supply and demand, utility

theory, etc, then they go to marketing classes and learn how to influence

human choices.

In economics class they learn that people make choices based on their

personal assessment of perceived utility and that people are autonomous

rational utility calculating individuals. Then they go to marketing class and

learn how to break all those “rules” and "manage perceptions".

The economics class, however, provides the justification

for the marketing class. The marketing student learns that markets operate

according to mathematical formulas, people make rational decisions, everyone is

responsible for their own decisions, and everyone maximizes their own utility.

All the marketer is doing, according to this school of

thought, is helping people to maximize their utility.

Indeed several studies, including a 1993 study published in the

Journal of Economic Perspectives,

Does Studying Economics Inhibit Cooperation?, found that students

studying economics at American universities actually become more

self-centered and less concerned with fairness or community interests.

The unscientific doctrine of Neoclassical economics rationalizes the use of

science to manipulate human behavior.

Marketing is based on real science because there is a

direct demand for marketing to produce real-world results. The demand for real-world results means that marketers base their studies on real science,

because only real science can produce an accurate model of reality, and only an

accurate model of reality can inform people so that real-world decisions can be made

that produce predictable results.

Interestingly, marketing uses science to understand the

real-world in order to present an artificial world to other people.

What the marketers know, of course, that they “secretly”

agree not to tell the economists, is that human beings are not rational, they

are not well informed, and they don’t always have a good concept of how to

"maximize utility".

As a true science, marketing is advancing well

beyond the school of economics. Marketing currently employs the use of

biologists, anthropologists, sociologists, psychologists, evolutionary

behaviorists, medical doctors, and a host of scientific and medical equipment.

In fact, a new term is being used to describe the science of marketing: "Buyology".

Marketers need real ways to

determine how people think and make decisions so that they can determine how to

influence what people think and, therefore, how to influence their decision

making processes.

The problem, of course, is that marketing is not a study of

systems, per se, although it’s arguable that as marketing becomes more advanced

it is becoming a study of entire social systems. Marketing is the study and

practice of influencing human behavior in ways that maximize the interests of

one side of a transaction. In other words, marketing is the practice of making

economic transactions as one sided as possible. As such, marketing cannot, and

does not, serve the broader interest of understanding economic systems, and does

not take a balanced view of economic transactions.

It does, however, illustrate the major difference in how

human choice is understood by two schools of thought that are very closely

related. Marketing uses science to understand the reality of human choice -

Neoclassical economics works from broad and unsupported assumptions

about human choice.

There is much more to this story than first meets the eye

however. Why should such a major school of thought be so deeply and obviously

flawed? After all, we are talking about how millions of people around the world

have been instructed to think about economics for the better part of the 20th

century through to today.

In order to understand why economics is the way that it is

today you have to understand the history of economic thought.

A Brief History of Economic Thought

Many people consider Adam Smith to be the father of modern

economics. Of course he wasn’t the very first economic thinker, economic

thinkers date back to antiquity, and include such men as Aristotle and Plato. Men like

Thomas Hobbes and John Locke predate Adam Smith by a short time as well, and

formed a part of the philosophical foundation upon which Smith and others built. The

field of "political economy" grew substantially after Adam Smith with many people

contributing economic ideas and models. David Ricardo is the most well know

Classical economist to come after Smith.

|

Adam Smith |

David Ricardo |

Both Adam Smith and Ricardo shared an opposition to the

wealthy, and sought to develop an understanding of business systems in such a

way as to provide direction and benefit for the common man. The works of both

Smith and Ricardo are tinged with disdain for the rich and use an outright

definition of society along class lines. Both Smith and Ricardo saw class

antagonism as a part of the world and inherent in economic systems.

The different orders of people who have ever been

supposed to contribute in any respect towards the annual produce of the

land and labour of the country, they divide into three classes. The

first is the class of the proprietors of land. The second is the class

of the cultivators, of farmers and country labourers, whom they honour

with the peculiar appellation of the productive class. The third is the

class of artificers, manufacturers, and merchants, whom they endeavour

to degrade by the humiliating appellation of the barren or unproductive

class.

The unproductive class, that of merchants,

artificers, and manufacturers, is maintained and employed altogether at

the expence of the two other classes, of that of proprietors, and of

that of cultivators. They furnish it both with the materials of its work

and with the fund of its subsistence, with the corn and cattle which it

consumes while it is employed about that work. The proprietors and

cultivators finally pay both the wages of all the workmen of the

unproductive class, and of the profits of all their employers. Those

workmen and their employers are properly the servants of the proprietors

and cultivators. They are only servants who work without doors, as

menial servants work within. Both the one and the other, however, are

equally maintained at the expence of the same masters. The labour of

both is equally unproductive. It adds nothing to the value of the sum

total of the rude produce of the land. Instead of increasing the value

of that sum total, it is a charge and expence which must be paid out of

it.

- Adam Smith; The Wealth of Nations, 1776

Civil government, so far as it is instituted for

the security of property, is in reality instituted for the defence of

the rich against the poor, or of those who have some property against

those who have none at all.

- Adam Smith; The Wealth of Nations, 1776

The produce of the earth — all that is derived from

its surface by the united application of labour, machinery, and capital,

is divided among three classes of the community; namely, the proprietor

of the land, the owner of the stock or capital necessary for its

cultivation, and the labourers by whose industry it is cultivated.

- David Ricardo; The Principles of Political

Economy and Taxation, 1817

When wages rise, it is always at the expense of

profits, and when they fall, profits always rise.

- David Ricardo; The Principles of Political

Economy and Taxation, 1817

If the corn is to be divided between the farmer and

the labourer, the larger the proportion that is given to the latter, the

less will remain for the former. So if cloth or cotton goods be divided

between the workman and his employer, the larger the proportion given to

the former, the less remains for the latter.

- David Ricardo; The Principles of Political

Economy and Taxation, 1817

The work of Smith and Ricardo, as well as other Classical

economists, was heavily structured around both logic and observation of human life.

The Classical economists were largely observers of men and of business. They

based their work on what they could discern about human behavior. There is

almost no math in the works of Adam Smith. His works are discussions of how

various practices and regulations affected people’s daily lives.

For example, Smith dedicated significant portions of his

works to the effects of taxes and how different taxes influenced people’s

decisions. One case that he discussed was the use of the window tax in England.

The Crown of England instituted a tax

that was based on how many windows a person had in their house. The idea was

that wealthier people had bigger houses and more money to build more windows.

The reality was somewhat different, as Adam Smith noted:

The principal objection to all such taxes of the worst is their

inequality, an inequality of the worst kind, as they must frequently

fall much heavier upon the poor than upon the rich. A house of ten

pounds rent in a country town may sometimes have more windows than a

house of five hundred pounds rent in London; and though the inhabitant

of the former is likely to be a much poorer man than that of the latter,

yet so far as his contribution is regulated by the window-tax, he must

contribute more to the support of the state. Such taxes are, therefore,

directly contrary to the first of the four maxims above mentioned.

- Adam Smith; The Wealth of Nations, 1776

Smith's most famous statement, though, was his statement about how the

pursuit of self-interest can serve the common good:

But the annual revenue of every society is always precisely equal to

the exchangeable value of the whole annual produce of its industry, or

rather is precisely the same thing with that exchangeable value. As

every individual, therefore, endeavours as much as he can both to employ

his capital in the support of domestic industry, and so to direct that

industry that its produce may be of the greatest value; every individual

necessarily labours to render the annual revenue of the society as great

as he can. He generally, indeed, neither intends to promote the public

interest, nor knows how much he is promoting it. By preferring the

support of domestic to that of foreign industry, he intends only his own

security; and by directing that industry in such a manner as its produce

may be of the greatest value, he intends only his own gain, and he is in

this, as in many other cases, led by an invisible hand to promote an end

which was no part of his intention. Nor is it always the worse for the

society that it was no part of it. By pursuing his own interest he

frequently promotes that of the society more effectually than when he

really intends to promote it. I have never known much good done by those

who affected to trade for the public good. It is an affectation, indeed,

not very common among merchants, and very few words need be employed in

dissuading them from it.

- Adam Smith; The Wealth of Nations, 1776

These are the types of things that Adam Smith wrote about,

how policies and practices affect people’s choices, and Smith promoted the view

that government policies and practices should be designed to minimize the impact

on people's economic decisions, which developed into the concept of the

“free market”.

David Ricardo included a little more math in his

discussions of economics, but not much. His works, again, were primarily studies

of human behavior, business practices, and government policies. Both Smith and

Ricardo agreed that there was a fundamental contradiction between the interests

of wage-laborers and capital owners, and both Smith and Ricardo concluded that

industry was ultimately doomed to fail and come to ruin on its own accord due to

inherent contradictions within economic systems. They did both, however,

proscribe as many ways as possible to improve industry as much as possible in

the mean time.

Neither Smith nor Ricardo were scientists, but at this

point economics (which was not a term that was actually used at that time) was

on its way to becoming a true science and to adopting scientific approaches to

problem solving - it was in the process of becoming more scientific.

Despite this move toward science, however, “economics” was

still very much influenced by the dominant worldview of the West at that time:

Christianity.

The world operated,

according to most people at that time, according to God’s plan, and in ways that

were influenced by God’s continuing intervention. In fact, men like John Locke

used the philosophical implications of a world created by a perfect god to support calls

for economic and social liberalism. Many the Enlightenment thinkers used the

concept of a just god to oppose the control of the Catholic

dominated political systems of Europe. God was in charge, so why did we need

popes and kings?

For many people poverty was a sign that someone was a spiritually insufficient or bad

person. Wealth was a blessing from God and a sign that someone was a good

person. The mind was insubstantial, i.e. supernatural, and not completely influenced by

physical reality. People were, ultimately, their souls. Who you were and what

type of decisions you made were viewed as a product of your soul. Your soul was

what dictated your personality and was seen as the root motivator in

decision-making. Therefore, the decisions that you made as an individual were a

reflection, directly, of who you were spiritually. Bad people made bad decisions,

and good people made good decisions. Good people had blessings bestowed upon

them, and bad people were subjected to suffering by God as a penance for their

sins. Success was proof of godliness.

While Smith and Ricardo were beginning to break away from

these views, they had still not fully done so. God doesn’t play a role in Adam

Smith’s The Wealth of Nations, but the idea of the soul as decision maker

still implicitly exists. Smith and Ricardo didn’t take the moralistic view of economics:

That poor people were poor because God wanted them to be poor or because they

were bad people. In fact, what is so striking and so magnificent about Adam

Smith’s work is his clear position that poverty was a condition to be solved. In

many ways, his book was a study of how to eliminate poverty and create a “fair”

system of opportunity for everyone. The Wealth of Nations was indeed a

controversial book in its day; it criticized the government, reprimanded the

aristocracy, and took the side of the poor and disenfranchised, stating that

their poor conditions were a product of bad policy and that the rich profited

from the exploitation of the poor.

The rise of profit operates like compound interest. Our merchants and

master-manufacturers complain much of the bad effects of high wages in

raising the price, and thereby lessening the sale of their goods both at

home and abroad. They say nothing concerning the bad effects of high

profits. They are silent with regard to the pernicious effects of their own

gains. They complain only of those of other people.

- Adam Smith; The Wealth of Nations, 1776

Adam Smith was clearly a genius, who was a very

progressive thinker and who greatly advanced how society and industry were

viewed. Smith did, however, live in the 1700s. A scientific understanding of

human beings and how people function mentally simply didn’t exist during his lifetime.

Adam Smith was pushing the envelop of understanding of human behavior and

society, but he had to operate within the realm of knowledge that existed in his

time, obviously. Like virtually everyone else in his time, Smith viewed the mind

as supernatural. Smith, like many during the Enlightenment, viewed the

supernatural human mind as rational.

Smith was of the Enlightenment school of thought that what

“made us human” was our rationality, and that the worldly desires and emotions

that people had were what we shared in common with the animals, and that these

irrational aspects of thought could be, and would be, overcome by the rational

supernatural mind. It was these "animalistic" desires that we were supposed to

overcome spiritually.

The train of regulated thoughts is of two kinds: one, when of an

effect imagined we seek the causes or means that produce it; and this is

common to man and beast. The other is, when imagining anything

whatsoever, we seek all the possible effects that can by it be produced;

that is to say, we imagine what we can do with it when we have it. Of

which I have not at any time seen any sign, but in man only; for this is

a curiosity hardly incident to the nature of any living creature that

has no other passion but sensual, such as are hunger, thirst, lust, and

anger.

- Thomas Hobbes (early Enlightenment thinker);

The Leviathan, 1660

Throughout history the supernatural mind has been seen as

the origin of free will. This, according to many throughout the ages, is what

separated people from all other forms of life. From Greek and Roman thinkers to

the Christians who took over the Roman Empire, animals have been largely viewed

as machines, unthinking, unfeeling, without a soul, and thus without free will.

Interestingly, many major Christian thinkers have viewed the world in strikingly

deterministic ways throughout history, with human thought being the only earthly exception to the

laws of nature.

This does come in part from the Greek and Roman roots within early

Christianity, a major difference, however, is that some schools of Greek and

Roman thought didn’t make exception for humans in the deterministic universe.

The existence of “free will” was always in question in Greek and Roman

philosophy - some believed in it, some did not.

The worldview of Adam Smith, unlike some of his predecessors,

involved a world where God wasn’t directly meddling

in the affairs of men, and poverty wasn’t a sign of spiritual deficiency but

rather a product of bad economic policy. Wealth wasn’t a blessing from God but

rather a product of good planning, hard work, and good social policy. Every

individual had a rational free will, which was an immaterial product of the soul.

God took care of the universe, but man took care of man.

This is generally the view that persisted into the 1800s

among the majority of educated thinkers. The “older”, more conservative view, however,

still persisted - that God was taking an active role in life and that a person’s

economic condition was a reflection of their spiritual condition. A strikingly different view

came to prominence in the 1800s as well though.

This "new" view was a purely “material” view, known as

Materialism. Philosophical Materialism had been around in Western society since

the time of the Greeks, but was mostly vanquished by the Christian Church once

Rome became Christianized, although, as has been mentioned, some aspects of

Greek and Roman Materialism were incorporated into both Judaism and

Christianity.

The Materialist philosophy that reemerged during the 1600s and came to prominence during

the 19th century was largely atheistic. This view held that there is

no soul and there is nothing supernatural, and thus there is no supernatural

aspect to the mind - the mind is purely a product of the physical brain and is

completely governed by the laws of nature, and thus able to be studied by

science.

This was a view shared by the 19th century’s

most famous philosopher-economist, Karl Marx.

Karl Marx

Marx was a strict Materialist, and as such he framed

economics in the light of history and science. As a Materialist and Humanist,

Marx viewed the objective of economics to be the establishment of complete

justice.

For Marx, justice is the central human quality - it is what

makes us human. Our humanity is defined by our justice. Nature is without cause,

without purpose, and, most importantly, without justice. The only meaning in life

is the meaning that we impart to it, and the only justice in the world is the

justice that human beings create. Therefore, according to Marx, the goal of life

is to create justice, and for Marx this meant economic justice.

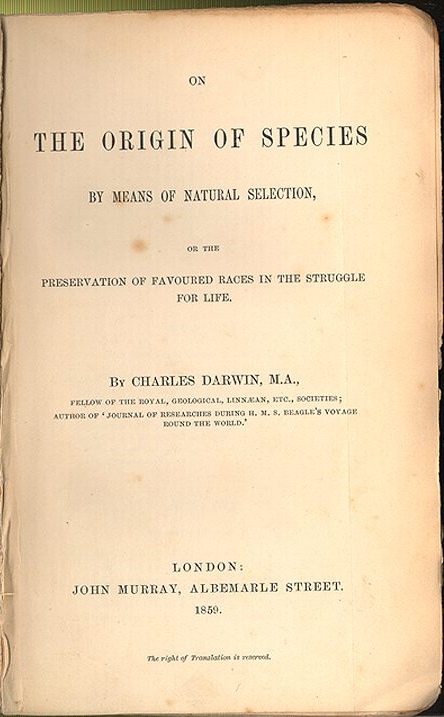

Marx lived during the time when Darwin published his Theory

of Natural Selection. Marx viewed Darwin’s theory of evolution as a validation of his worldview, and as a compliment to his theory of “social

evolution”: The Class Struggle.

Of Darwin's works Marx wrote:

During my time of trial, these last four weeks I have read all sorts

of things. Among others Darwin's book on Natural Selection. Although it

is developed in the crude English style, this is the book which contains

the basis in natural history for our view.

- Karl Marx; Letter to Frederick Engels, 1860

Darwin’s work is most important and suits my purpose in that it

provides a basis in natural science for the historical class struggle.

One does, of course, have to put up with the clumsy English style of

argument. Despite all shortcomings, it is here that, for the first time,

‘teleology’[2] in natural science is not only dealt a mortal blow but

its rational meaning is empirically explained.

- Karl Marx; Letter to Ferdinand Lassalle, 1861

A critical history of technology would show how little any of the

inventions of the 18th century are the work of a single individual.

Hitherto there is no such book. Darwin has interested us in the history

of Nature's Technology, i.e., in the formation of the organs of plants

and animals, which organs serve as instruments of production for

sustaining life. Does not the history of the productive organs of man,

of organs that are the material basis of all social organisation,

deserve equal attention? And would not such a history be easier to

compile, since, as Vico says, human history differs from natural history

in this, that we have made the former, but not the latter?

- Karl Marx; Das Capital, 1867

Marx, of course, lived before the discovery of DNA and the

understanding of genetics and biology that we have today. In Marx’s time

biology was still mostly a study of what things existed - it was mostly just a

practice of naming and cataloging “species”.

Marx obviously did not have as advanced a scientific

understanding of life and of how the mind works as we have today, but he did put

science at the forefront of his worldview and did advocate a scientific approach

to the study of all things, including economics and human behavior.

While Marx didn’t apply science to economics or the study

of human behavior himself, he, like Adam Smith, Ricardo and others before

him, made a number of observations about life and human behavior in very

detailed and profound ways. He made claims which could be verified by science,

although he didn't perform the science to verify them. Some of his claims have

proven true, some of his claims have proven false, and a number of them have

never been verified either way.

Regardless, Marx brought economics further into the realm

of science. Just as Western views of economics had been integrated with a

Christian worldview prior to Marx, Marx integrated economics with a Materialist

worldview, i.e. a purely natural worldview, where “free will” was once again in

question, and people’s choices were seen purely as natural processes that are

governed by the laws of nature. Marx also took people’s emotions into greater

consideration as well, which played a major role in his theories on commodity

fetishism, human social identity, and religion.

The basis of irreligious criticism is: Man makes religion, religion does

not make man. Religion is the self-consciousness and self-esteem of man who

has either not yet found himself or has already lost himself again. But man

is no abstract being encamped outside the world. Man is the world of man,

the state, society. This state, this society, produce religion, an inverted

world-consciousness, because they are an inverted world. Religion is the

general theory of that world, its encyclopedic compendium, its logic in a

popular form, its spiritualistic point d'honneur, its enthusiasm, its moral

sanction, its solemn complement, its universal source of consolation and

justification. It is the fantastic realization of the human essence because

the human essence has no true reality. The struggle against religion is

therefore indirectly a fight against the world of which religion is the

spiritual aroma.

Religious distress is at the same time the expression of real distress

and also the protest against real distress. Religion is the sigh of the

oppressed creature, the heart of a heartless world, just as it is the spirit

of spiritless conditions. It is the opium of the people.

...

The task of history, therefore, once the world beyond the truth has

disappeared, is to establish the truth of this world. The immediate task of

philosophy, which is at the service of history, once the holy form of human

self-estrangement has been unmasked, is to unmask self-estrangement in its

unholy forms. Thus the criticism of heaven turns into the criticism of the

earth, the criticism of religion into the criticism of law and the criticism

of theology into the criticism of politics.

...

But for man the root is man himself. The evident proof of the radicalism

of German theory, and hence of its practical energy, is that it proceeds

from a resolute positive abolition of religion. The criticism of religion

ends with the teaching that man is the highest being for man, hence with the

categorical imperative to overthrow all relations in which man is a debased,

enslaved, forsaken, despicable being;...

- Karl Marx; Introduction to A Contribution to the Critique of Hegel’s Philosophy of Right, 1844

For Marx, people were not rational beings, nor were they

machines like the Greek or Christian view of animals, but both humans and animals

were complex emotional beings, whose desires and decisions were influenced by

thousands of years of social practices and millions of years of natural

evolution. People were products of nature and could be affected by nature, i.e.

their environment. For Marx, the real world was the key to understanding human

behavior, not the “spiritual world”.

This was the key to Marxism: The idea that people are

products of their environment, and that the natural world is fundamentally

without justice.

The task of mankind, therefore, was to overcome nature, establish justice for

every person, and put an end to the cycle of “evolutionary favoritism”. After

all, if there is no just god, and there is no supernatural purpose to life, then the fact that one person happens to be born with qualities

that make him or her superior to another is just a “freak of nature” - it’s just

chance. The individual has done nothing to “earn” the “blessing”, it’s just a

"random" part of how the material universe works.

Hence the categorical Marxist imperative: “From each according to his ability, to

each according to his needs! ”

More specifically, Marx stated:

But one man is superior to another physically, or mentally, and

supplies more labor in the same time, or can labor for a longer time;

and labor, to serve as a measure, must be defined by its duration or

intensity, otherwise it ceases to be a standard of measurement. This

equal right is an unequal right for unequal labor. It recognizes no

class differences, because everyone is only a worker like everyone else;

but it tacitly recognizes unequal individual endowment, and thus

productive capacity, as a natural privilege. It is, therefore, a right

of inequality, in its content, like every right. Right, by its very

nature, can consist only in the application of an equal standard; but

unequal individuals (and they would not be different individuals if they

were not unequal) are measurable only by an equal standard insofar as

they are brought under an equal point of view, are taken from one

definite side only -- for instance, in the present case, are regarded

only as workers and nothing more is seen in them, everything

else being ignored. Further, one worker is married, another is not; one

has more children than another, and so on and so forth. Thus, with an

equal performance of labor, and hence an equal amount in the social consumption

fund, one will in fact receive more than another, one will be richer

than another, and so on. To avoid all these defects, right, instead of

being equal, would have to be unequal.

What Marx is saying here is that labor must be the standard by which

everyone's contribution to society is measured. By using labor as the standard

measure, everyone's contribution would be judged equally, as opposed to the

variety of financial means by which people acquire wealth, such as capital

gains, inheritance, etc. He recognized, however, that even if everyone were

judged by the same standard, i.e. the value produced by their labor, the fact

that everyone is different and has a different ability to contribute labor would

still result in inequality. So he says that the first stage of communism would

be to establish an equal measure of contribution, even though it will still

result in inequality, because at least people would all be judged on an equal

basis, according purely to the value of their labor. He goes on to state:

But these defects are inevitable in the first phase of communist

society as it is when it has just emerged after prolonged birth pangs

from capitalist society. Right can never be higher than the economic

structure of society and its cultural development conditioned thereby.

In a higher phase of communist society, after the enslaving

subordination of the individual to the division of labor, and therewith

also the antithesis between mental and physical labor, has vanished;

after labor has become not only a means of life but life's prime want;

after the productive forces have also increased with the all-around

development of the individual, and all the springs of co-operative

wealth flow more abundantly -- only then can the narrow horizon of

bourgeois right be crossed in its entirety and society inscribe on its

banners: From each according to his ability, to each according to his

needs!

- Karl Marx; Critique of the Gotha

Programme, 1875

Life was not fair, but we could make it that way, at least

according to Marx.

Well, as we all know, Marxism upset a great many people and

there was a concerted effort to disprove or contradict every aspect of Marxist

economics and thought. The first reaction by Marx’s opponents to his Das Kapital,

which was the first major book to use the term “capitalist”, was to ignore it.

The book was large, complicated, and hard to read, so the

hope was that his intended audience, miners and factory workers, etc, wouldn’t

be able to make much of it anyway. The book caught on however, and many other

writers, including Marx himself and his associate Engels, wrote companion pieces

that broke down the major points into more easily digestible bits.

Eventually, the opponents of Marxism had to present counter

arguments and develop their own counter school of economic thought because Marx,

it was widely acknowledged, had indeed exposed major flaws in existing

"capitalist" economic theory.

The first group of people to counter Marx were members of the Austrian School of

economics. Many concepts from the Austrian School have become integrated

into Neoclassical economics, but other economists, businessmen, clergymen

and politicians

contributed to the countering of Marxism as well.

One aspect of Marxism is that everything is integrated.

Marxism is a fully integrated holistic worldview and system of analysis.

Therefore you cannot separate Marxist economics from Marxist views on religion

or science or philosophy or history or anything else. Every school of

thought in Marxism plays a supporting role for other schools of thought.

This, of course, made Marxism attackable on multiple

fronts. In order to attack Marx’s economics one could just as easily attack

Marx’s view on religion or history or anything else, and that is exactly what

happened.

After over one hundred years of progress in the school of

economics as a science, “Neoclassical” economists in the late 1800s took a big

step backward in time and made a fundamental, and unverifiable, assertion: That

people have an autonomous rational free will. Members of the Austrian School, such as Ludwig

von Mises in the 20th century, directly denied the role of observation in

economics, stating that human behavior was too difficult to study

scientifically, and instead that human behavior models should be derived

logically. Specifically Mises stated:

The science of human action that strives for universally valid

knowledge is the theoretical system whose hitherto best elaborated

branch is economics. In all of its branches this science is a priori,

not empirical. Like logic and mathematics, it is not derived from

experience; it is prior to experience. It is, as it were, the logic of

action and deed.

...

The popular epistemological doctrines of our age do not admit that a

fundamental difference prevails between the realm of events that the

natural sciences investigate and the domain of human action that is the

subject matter of economics and history. People nurture some confused

ideas about a "unified science" that would have to study the behavior of

human beings according to the methods Newtonian physics resorts to in

the study of mass and motion. On the basis of this allegedly "positive"

approach to the problems of mankind, they plan to develop "social

engineering," a new technique that would enable the "economic tsar" of

the planned society of the future to deal with living men in the way

technology enables the engineer to deal with inanimate materials.

These doctrines misrepresent entirely every aspect of the sciences of

human action.

As far as man can see, there prevails a regularity in the succession

and concatenation of natural phenomena. Experience, especially that of

experiments performed in the laboratory, makes it possible for man to

discern some of the "laws" of this regularity in many fields even with

approximate quantitative accuracy. These experimentally established

facts are the material that the natural sciences employ in building

their theories. A theory is rejected if it contradicts the facts of

experience. The natural sciences do not know anything about design and

final causes.[2]

Human action invariably aims at the attainment of ends chosen. Acting

man is intent upon diverting the course of affairs by purposeful conduct

from the lines it would take if he were not to interfere. He wants to

substitute a state of affairs that suits him better for one that suits

him less. He chooses ends and means. These choices are directed by

ideas.

The objects of the natural sciences react to stimuli according to

regular patterns. No such regularity, as far as man can see, determines

the reaction of man to various stimuli. Ideas are frequently, but not

always, the reaction of an individual to a stimulation provided by his

natural environment. But even such reactions are not uniform. Different

individuals, and the same individual at various periods of his life,

react to the same stimulus in a different way.

As there is no discernible regularity in the emergence and

concatenation of ideas and judgments of value, and therefore also not in

the succession and concatenation of human acts, the role that experience

plays in the study of human action is radically different from that

which it plays in the natural sciences. Experience of human action is

history. Historical experience does not provide facts that could render

in the construction of a theoretical science services that could be

compared to those which laboratory experiments and observation render to

physics. Historical events are always the joint effect of the

cooperation of various factors and chains of causation. In matters of

human action no experiments can be performed. History needs to be

interpreted by theoretical insight gained previously from other sources.

This is valid also for the field of economic action. The specific

experience with which economics and economic statistics are concerned

always refers to the past. It is history, and as such does not provide

knowledge about a regularity that will manifest itself also in the

future. What acting man wants to know is theory, that is, cognition of

the regularity in the necessary succession and concatenation of what is

commonly called economic events. He wants to know the "laws" of

economics in order to choose means that are fit to attain the ends

sought.

Such a science of human action cannot be elaborated either by

recourse to the methods praised—but never practically resorted to—by the

doctrines of logical positivism, historicism, institutionalism, Marxism

and Fabianism or by economic history, econometrics and statistics. All

that these methods of procedure can establish is history, that is, the

description of complex phenomena that happened at a definite place on

our globe at a definite date as the consequence of the combined

operation of a multitude of factors. From such cognition it is

impossible to derive knowledge that could tell us something about the

effects to be expected in the future from the application of definite

measures and policies, e.g., inflation, price ceilings, or tariffs. But

it is precisely this that people want to learn from the study of

economics

- Ludwig von Mises; Epistemological Problems of Economics,

1933

Understanding human action, according to von Mises, is beyond the realm of

science. This view, either implicitly or explicitly, is prevalent throughout

Neoclassical economic thought.

Because opposition to Marxism at the same time embodied an

opposition to his economics and to his views on religion, religious thinkers

became more involved in the school of economics, and philosophically religious concepts began

working their way back into major elements of major economic theory. I say philosophically religious concepts, because we are not talking about

Biblical principles or codes of religious law, but logical derivations based on

the idea that people are the creations of a perfect universal god and the

assumption of a supernatural soul as the source of free will. (In fact, however,

Neoclassical economics contradicts many Biblical principles)

Once again, people’s economic conditions and economic

choices were seen as a judge of their spiritual character. Wealth was seen as a

sign of virtue and piety, and poverty was seen as a sign of sinfulness and

divergence from God. This is not to say that all Neoclassical economists held

this view, but that the popular acceptance of Neoclassical economics was greatly bolstered by this view.

Economists, however, still viewed their work as a science

and, for a number of reasons, sought to bolster its scientific aroma. The

attempt to make economics appear to be a science resulted in a school of thought

that more closely resembled physics than anything else. As von Misis stated,

economics was to be viewed like mathematics, and Neoclassical economists have

treated it as such.

In addition, the opponents of Marx were largely

businessmen, so the economics that was developed in opposition to Marxism was

largely concerned with the functions of business and with metrics that were

viewed as useful to businessmen.

What the Neoclassical economists were not is they were not

scientists, they were not sociologists, they were not psychologists. In general,

they were not people concerned with the functioning of human beings - they were

people concerned with the functioning of business.

The Science of Human Behavior vs. Neoclassical Assumptions

It is impossible to remove the study of human behavior from

economics, but Neoclassical economists have effectively done just that. Neoclassical

economics makes major assumptions about human behavior, then dismisses the

subject as a topic of study. Instead, Neoclassical economics is filled with graphs

and formulas that are useful in making business decisions, managing money

supplies and interest rates, etc. Neoclassical economics employs the use of

self-defining non-verifiable concepts such as “maximizing utility”. In fact,

even the definition of rational self-interest has become devoid of meaning in

the economic textbooks of today.

In general, rational self-interest means that individuals try to maximize

the benefit achieved with a given cost or to minimize the expected cost of

achieving a given benefit. [1]

- Economics 6e, A Contemporary Introduction

This statement is essentially meaningless, and says nothing about how or why

people make decisions. It basically just says that any decision a person makes is

the decision that they thought was the best decision to make. Of course.

Choices in food, body art, music, clothing, reading, movies, TV - indeed,

all consumer choices - are influenced by tastes. Tastes are nothing more

than your likes and dislikes as a consumer. What determines tastes? Who

knows? Economists certainly don't, nor do they spend much time worrying

about the question. They recognize, however, that tastes are important in

shaping demand. [1]

- Economics 6e, A Contemporary Introduction

Neoclassical economists may not spend much time worrying about what

determines tastes, but marketers sure do. So much for rational self-interest.

In terms of justice, again the Neoclassical economists turn to self-defining concepts. For Neoclassicals the Market

is just.

Neoclassical economists will tell you that the Market is the definition of

economic justice, and that economic injustice comes from human "interference" in

“the Market”. Of course it's impossible to even have a market with human

“interference”, but never mind that.

The previously mentioned article, Does Studying Economics Inhibit Cooperation?, reported

on an

experiment conducted by Marwell and Ames, stating :

On completion of each replication of the experiment, Marwell and Ames

asked their subjects two followup questions:

1. What is a "fair" investment in the public good?

2. Are you concerned about "fairness" in making your investment

decision?

In response to the first question, 75 percent of the noneconomists

answered "half or more" of the endowment, and 25 percent answered "all."

In response to question 2, almost all noneconomists answered "yes." The

corresponding responses of the economics graduate students were much

more difficult to summarize. As Marwell and Ames wrote,

.... More than one-third of the economists either refused to

answer the question regarding what is fair, or gave very complex,

uncodable responses. It seems that the meaning of 'fairness' in this

context was somewhat alien for this group. Those who did respond

were much more likely to say that little or no contribution was

'fair.' In addition, the economics graduate students were about half

as likely as other subjects to indicate that they were 'concerned

with fairness' in making their decisions.

The significance of this study is the finding that individuals' views on

"economic fairness" actually changed due to studying Neoclassical economics,

becoming less concerned with fairness after studying economics at American

universities.

Neoclassical economics partially developed as a

contradiction to everything Marxist. Whatever Marx said, Neoclassical economists

said the opposite purely out of opposition. Perhaps the most prominent message

of Marxist economics was that the economy should be fair. Fair was the buzzword

of Marxists so it became the bane of Neoclassicals.

Likewise, the Marxist focus on human behavior, and the

view of the mind as a product of the material nature of the brain that is

heavily influenced by emotions and the environment, contributed to the Neoclassical

acceptance of the mind as an isolated agent of rational free will and a lack of

focus on human behavior.

Neoclassical economics, therefore, is ultimately reliant on

faith, and on an acceptance of a supernatural concept of the mind. Neoclassical

economics is rooted in teleology.

In a strange irony, by basing economics on the assumption

that people operate according to independent rational free will, Neoclassical

economics results in the promotion of irrational economic development.

By taking the position that people act in their

rational self-interest and that this is a good thing, so that nothing needs to be done other than

"get out of the

way" and let “the Market” operate, the door is opened for the manipulation of the

way that people really do make decisions. People actually are irrational, ill

informed, emotional and heavily influenced by their environment.

People are animals that are products of millions of years

of evolution. Our brains, and our mind, are subject to the laws of nature. Many

behaviors, preferences and patterns, etc are inherent in who we are - they are

a product of our genetics. All other behaviors, preferences and patterns are the

result of our environment, or more precisely, are the result of how our genetically determined material body interacts with the environment.

There are all manner of triggers and conditions that influence our

decision-making processes. These things have nothing to do with “souls”, nothing

to do with “free will”, nothing to do with an inherent intangible self, nothing

to do with rationality, and

nothing to do with morality.

By ignoring all of these things economists fail to

describe or understand how people make decisions.

For example, different colors stimulate different emotions

and assumptions in humans, as well as other animals. Color, therefore, impact

our decision-making processes for completely irrational reasons. Many of the

ways that color impacts our decision-making processes are a product of millions

of years of evolution in “the wild”, and have no direct bearing on the modern

world.

In certain contexts humans are attracted to

bright colors, and tend to shy away from dull colors such as brown.

One reason for this is that the primary sources of bright colors in the wild

are flowers and fruits. In the past humans relied on the use of color to

determine if fruits were ripe and in good condition to eat. Brown indicates that

a fruit is rotten or diseased, and brown plant material is dead plant material

that has no nutritional value to people.

Economics is all about decision-making processes. In

nature, the primary decision-making processes are about the acquisition of food.

Therefore, most of our decision-making thought processes in relation to the

acquisition of resources for consumption are related to the thought processes

that evolved to make decisions about food.

When a person is “shopping” they are heavily using the

centers of the brain that originally evolved to make decisions about what foods

to choose.

Those centers of the brain have evolved to be highly

sensitive to color and highly selective based on color. A million years ago in

the wild, homo-sapiens “shopping” for food that were on the lookout for brightly

colored objects were more likely to survive and be

successful because they would be more likely to find food.

There was an evolutionary advantage to being attracted to bright shiny

fruits and an evolutionary advantage to being turned off by dull brown fruit.

Therefore, people have evolved to generally be attracted to bright shiny colors

when in “resource acquisition mode".

There is nothing rational about this behavior today, it’s

simply a vestige of our evolutionary heritage. Obviously, millions or thousands

of years ago people didn’t shop for clothes or cars or little trinkets. Our

ancestors’ lives were primarily concerned with looking for food, staying away

from danger, and having sex.

Today, however, marketers make use of brightly colored

signs because they trigger a fundamental and deeply instinctive response in the

majority of human beings. A bright colored sign stimulates the region in the

brain that says “hey, there is something good over there, go check it out”.

Is it rational to make a judgment about the “utility” of a

good because it is sold under a red sign vs. under a brown sign? No, of course

not. The color of the sign advertising the product has nothing at all to do with

the quality or usefulness of the product, but studies have shown that if you put

two booths up with the same exact product, but one booth has a red or yellow

sign (common colors of fruits and flowers) and one has a brown sign, then the

booth with the red or yellow sign will do more business.

It’s a decision making process that is totally irrational and heavily

influenced by our biological makeup.

Food provides other excellent examples. Humans have four

types of taste: sweet, sour, salty and bitter. These tastes have evolved to tell

us about what we are eating. Our eating preferences have evolved over millions

of years based on the dietary requirements and living conditions of the wild. In

the wild it’s very hard to get enough to eat so people, along with essentially

all animals, have evolved a very strong appetite that drives us to eat as much

as possible.

Interestingly, mammal babies have a natural control mechanism to

their appetite. This has likely evolved because babies have always had a ready

supply of food that is essentially always available, and over-feeding by babies

is taxing on the mother who has to supply the milk that feeds them. Therefore,

babies that regulated their own caloric intake were naturally selected for.

At any rate, once mammals are past the breast-feeding age

their caloric intake becomes unregulated. Animals will generally try to consume

as much as they can hold because in the wild every meal is hard to come by and

no future meal is certain.

In addition, taste heavily influence choice about which

things to eat. People’s tastes have evolved to guide them to eat the most

nutritious and high calorie things, while avoiding poisonous things.

This is why people are highly attracted to both sweet food

and fatty food, while turned off by bitter foods. Sugar is basically the plant

form of fat. Fat and sugar are compounds that are used by living things to store

energy, which is why eggs are high in fat and fruits are high in sugars. They

both serve as sources of energy for newly developing life forms that do not yet

have the means to acquire their own resources. It's also why sugar is easily

transformed into fat by animals - the compounds are very similar.

In nature, sweet things are typically highly dense in nutrients

and relatively high in calories. This again is because sweet things in nature

are almost always part of a nutrient packet that is intended to supply the

needs of a developing life. Our sweet-tooth evolved to guild us

toward fruits and honey, etc (fruits evolved to feed plant seeds and honey is

produced by bees to feed their young). Both fruits and honey are high in

calories and high in vitamins and minerals when compared to other plant

material, such as leaves or wood or grass, etc.

Fatty materials, such as meats, were also highly

advantageous for survival as well, because they provide a high source of energy

and protein.

Many poisonous plants and insects, however, have a bitter taste. Not all

bitter foods are poisonous, and not all poisonous foods are bitter, but it

was a good enough rule of thumb to provide an evolutionary advantage for

those individuals that avoided bitter foods, and were thus less likely to

die from food poisoning.

Today, we still have these same tastes and we still have

basically the same brain that influences our decision-making processes and

instinctively favors sweet and fatty foods over other foods. The problem,

however, is that today, thanks to “advances” in technology, food producers are

able to isolate flavors and we have an abundant supply of food that is almost

always available.

What “the Market” has seized on, or rather what producers

have seized on, is the fact that people have a high affinity for sweet and fatty

foods.

The result is that, in order to maximize profits, they produce foods that are

purely just sweet and have zero nutritional value or are very fatty. Nutrients, of course, are

expensive.

Our brain has no way to determine how nutritious a food

actually is, and we certainly can’t taste “nutrition”. What has happened is that

our brain evolved a system over millions of years that provided a guide

to direct us towards nutritious foods in the wild. Now, that same instinctive guide

is “abused” by many food producers to effectively “trick” our brains into

thinking that we are eating nutritious food, when in fact we are eating food

that may be completely devoid of any redeeming value, or actually bad for our

health.

At an even more fundamental level, the hormone oxytocin, which stimulates

trust, is naturally produced by humans and other animals in a variety of

situations, such as after sex and in infants after child birth. In reality

the hormone is produced at various levels in response to a wide range of

stimuli, but the afore mentioned situations are times when some of the

highest concentrations are produced.

The scientific journal Nature recently published new finds about oxytocin.

Reporting on the Nature publication,

Building trust via nasal spray stated:

Commentators say that the study has implications for just about

everyone who takes an interest in any human behavior -- from love, to

politics, to marketing and beyond.

"Some may worry about the prospect that political operators will

generously spray the crowd with oxytocin at rallies of their

candidates," said University of Iowa neurologist Antonio Damasio in a

commentary in Nature.

"The scenario may be rather too close to reality for comfort, but

those with such fear should note that current marketing techniques...

may well exert their effects through the natural release of molecules

such as oxytocin in response to well-crafted stimuli."

How can Neoclassical economics possibly take these types of factors

into account? Quite simply, it can’t.

The basic examples given above only scratch the surface of the scientific

understanding human choice.

Not only does Neoclassical economics assert that we are

rational beings, but Neoclassical economists have by and large completely

removed human beings from our evolutionary context. Indeed, many Neoclassical

economists, either explicitly or implicitly, put people in the Christian context of a world created by a just

god.

This view of a world created by a just god implies, of course, that the natural

state of the world is just, and that it is human activity that creates injustice

(original sin). This, as has been noted, is the diametrical opposite of the

Marxist worldview, that the natural world is inherently without justice and that

it is humanity that creates justice.

The Neoclassical view is inherently rooted in the view of a created world and

created people, where humans have no historical development, no evolutionary

narrative, and no social context. According to the Neoclassical view we aren’t

all unique complex organic beings with a common evolutionary line whose

cognitive processes reside in, and are affected by, the real world. Instead, we

are all rational creations that have been flawed by original sin,

meaning that any non-rational behavior is the result of moral flaw, and thus

acceptably outside the parameters of market theory. Why worry about "bad people"

anyway?

With this view, non-rational and social behavior is not

something to be incorporated into the economic model, but rather the individual

is to be “blamed” for lack of rationality; thus non-rational behavior becomes

fair game to “exploit”. Social considerations are outside the scope of “rational

self-interest”.

Conclusion

The result of this view is clear in America today. Almost every

day some statement or report is issued telling us that Americans are saving too

little, spending too much, and are too deep in debt.

Yet, at the same time, the amount of resources spent on

advertising every year continues to increase. Over $100 billion a year is used in

America to persuade people to engage in the very same behavior that virtually every

economist is telling us is the wrong behavior to engage in.

At what point will economists be forced to acknowledge that

using an economic model predicated on the assumption that all people are

rational and informed about every decision they make results in

a nonworking model, upon which it is impossible to structure our economy and our

lives? Furthermore, Neoclassical economics makes the basic assumption that

self-interest is the appropriate basis for all decisions. Ironically, this is a

view that goes contrary to virtually every religion and social system in the

history of mankind, and is indeed contrary to our social evolutionary

development.

Thus far, at the microeconomic level these concerns have been

generally dismissed for decades. If someone is “suckered” by advertising or

product placement then it’s “their own fault”. If someone doesn’t control their

spending and goes massively into debt then it’s “their own fault”.

The problem, however, is that on a macroeconomic level,

when these conditions become prevalent throughout the population, the entire

economy runs into trouble. It is no longer an “individual” problem; it is a

problem for everyone.

The problem arises, in part, because of an economic system that does not

recognize human beings for what we really are: intelligent animals. Intelligent,

but animals nonetheless, with an evolutionary and social history that greatly

influences our decision-making processes.

In addition, free market theory is highly dependant upon the assumption

that people are fully informed about the decisions that they make. This is

clearly not the case, and indeed free-market practice results in the

development of an economic system where sellers of goods and services use

every means possible to skew the perception of buyers, and are able to

develop substantial advantages in information management over individual

buyers. Free-market theory basically states that if individuals are rational

and informed then the decisions that they make will always be the "best"

decisions, and this will result in the success of businesses that best serve

the "social good". The problem, of course, is that people aren't rational, and

not only do people make uninformed decisions, but indeed the very businesses

that are active in the markets work to undermine our ability to make

informed decisions. Virtually all businesses present very one sided views of

their products and they hide as much information about how their business

operates as possible. This is a fundamental contradiction in free-market

theory. Businesses themselves work to undermine the very principles of the

system.

This problem is exacerbated by the fact that the acceptance of

Neoclassical economic theory tends to make people more self-centered, less

honest, less concerned with fairness, and more likely to pursue "free rider"

behavior. Free rider behavior is defined as taking private advantage of

public resources. This makes perfect sense, because it is in one's rational

self-interest to take advantage of public resources for personal gain.

Average people, non-economists, live by many principles regarding public

good and community values. These principles may be learned or

instinctive, but Neoclassical economics teaches a disdain for these

principles and espouses the virtue of pure self-interest and competition.

The result is that not only economists, but all of those people who study

Neoclassical economics, such as marketers, businessmen and

executives,

have fundamentally different sets of priorities and norms by which they

operate, which are outside the norms of the broader community.

Other scientific fields of human study have proven, and now accept, that

human choice is governed by our genetics and by our environment. The mind is material, and is increasingly being accepted as such by

many schools of study and the general public. Our brains and our thoughts

are affected by chemicals, developmental processes, social interactions, and

by the very structure of the brain itself. The human mind can be studied by

science. Right now industry and marketing are playing a double game. They

study the human mind scientifically in order to understand how to influence

human choice, but continue to espouse an economic model that denies the

ability of the human mind to be studied by science. The result is that the

public is continually led to believe that their choices cannot be influenced

by marketing, etc, while in fact the the marketers, etc are studying and

practicing increasingly effective ways to influence human choice.

Neoclassical economics is predicated on an assumption that has been

outdated for over 100 years, and it's time that we base our economics on reality.

Footnote:

[1] Economics 6e, A Contemporary Introduction;

William A. McEachern, 2003. This is a popular college level macroeconomics

and microeconomics textbook that is endorsed by The Wall Street Journal.

[2] Teleology: Philosophy or doctrine that attempts to explain the universe in

terms of ends or final causes. Teleology is based on the proposition that the

universe has design and purpose. In Aristotelian philosophy, the explanation of,

or justification for, a phenomenon or process is to be found not only in the

immediate purpose or cause, but also in the "final cause"—the reason for which

the phenomenon exists or was created. In Christian theology, teleology

represents a basic argument for the existence of God, in that the order and

efficiency of the natural world seem not to be accidental. If the world design

is intelligent, an ultimate Designer must exist.

Teleologists oppose mechanistic interpretations of the universe

that rely solely on organic development or natural causation. The powerful

impact of Charles Darwin's theories of evolution, which hold that species

develop by natural selection, has greatly reduced the influence of traditional

teleological arguments. Nonetheless, such arguments were still advanced by many

during the upsurge of creationist sentiment in the early 1980s.

|